Advertisement|Remove ads.

Credo’s Record Earnings, Blowout Q3 Guidance Sends Shares Soaring Premarket – CFO Signals Aggressive Growth Plans

- Credo expects third-quarter revenue in the range of $335 million to $345 million, a 27% sequential increase.

- Operating costs are projected to climb about 50% year over year in fiscal 2026.

- Credo’s second-quarter revenue and earnings per share exceeded Street’s estimates.

Credo Technology Group (CRDO) Chief Financial Officer Daniel Fleming said the company intends to keep investing aggressively in growth initiatives while preserving a sizable cash reserve to support operations.

Speaking on the second-quarter earnings call, Fleming said Credo expected further diversification across its customer base, helping dissipate revenue concentration risks.

“We also expect revenue diversification to strengthen further with our fourth customer surpassing the 10% revenue threshold for this fiscal year,” Fleming added.

Growing Outlook For Q3

The CFO stated that revenue for the third quarter will be in the range of $335 million to $345 million, a 27% sequential increase. The revenue guidance is above the analysts’ consensus estimate of $247.6 million, according to Fiscal AI data.

Fleming suggested Q3 adjusted gross margin to land between 64% and 66%, suggesting continued stability in profitability. Operating costs are projected to climb about 50% year over year (YoY) in fiscal 2026 as the company continues scaling its workforce and infrastructure.

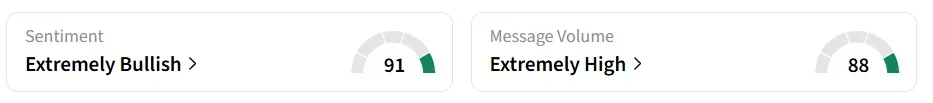

Credo Technology’s stock traded over 17% higher in Tuesday’s premarket. On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

Strong Q2 Earnings

Credo posted second-quarter 2026 revenue of $268 million, a whopping 272.1% jump YoY. Adjusted earnings per share (EPS) were $0.67 per share. Both revenue and EPS surpassed the analysts’ consensus estimate of $234.9 million and $0.5, according to Fiscal AI data.

“These are the strongest quarterly results in Credo’s history, and they reflect the continued build-out of the world’s largest AI training and inference clusters.”

-Bill Brennan, President and CEO, Credo

CRDO stock has gained over 154% in 2025 and 258% in the last 12 months.

Also See: Hey Siri, Is Apple Done Sleeping On AI? Wall Street Is Hunting For Clues Of An Awakening

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)