Advertisement|Remove ads.

Why Did GCL Stock Soar 53% Pre-Market Today?

- The latest stake purchase closed at $2.50 per share, valuing 4Divinity at roughly $250 million.

- The fresh influx of capital aims to expand GCL’s footprint in the worldwide games and entertainment sector.

- Beyond financial backing, GCL and ADATA plan to evaluate collaborative products.

GCL Global Holdings (GCL) announced on Friday that 4Divinity Pte., its publishing unit, has received an additional $10 million from ADATA Technology Co., on top of a prior $3 million infusion.

The fresh influx of capital for its publishing arm aims to expand GCL’s footprint in the worldwide games and entertainment sector.

Investment Details

The latest stake purchase closed at $2.50 per share, valuing 4Divinity at roughly $250 million. The capital is earmarked to help the subsidiary scale up its current development slate and secure additional high-profile game titles that resonate internationally.

The investment will also help 4Divinity pursue prominent interactive titles and expand digital distribution systems. Following the announcement, GCL stock traded over 53% higher

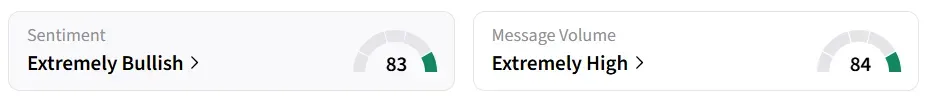

On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

Joint Growth Initiatives

Beyond financial backing, GCL and ADATA plan to evaluate collaborative products that weave together game content and hardware. This could include memory products and gaming accessories bearing exclusive game intellectual property.

“With this second investment, we are ensuring 4Divinity has the financial agility to accelerate market share capture and integrate our technological DNA into the gaming experiences of tomorrow through customized hardware and IP-driven products.”

-Simon Chen, Chairman and CEO, ADATA

GCL Global, through its subsidiaries, develops games and entertainment products that combine content and hardware, helping developers reach and engage gamers worldwide.

GCL stock has declined by over 81% in the last 12 months.

Also See: VZ Stock Rises Pre-Market As Verizon Lays Out Bullish 2026 Growth Outlook

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)