Advertisement|Remove ads.

Why Did Oracle Stock Rise 4% Today?

Oracle Corp. (ORCL) has attracted investors’ attention after reports that the tech giant, along with a consortium of other companies, could play a role in a potential agreement between the U.S. and China that would allow TikTok to maintain operations.

According to a CBS News report, although the complete structure of the agreement is still being finalized, sources indicate that the deal is expected to involve several companies.

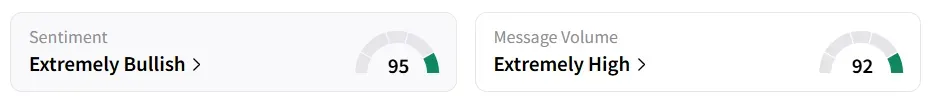

Oracle stock traded over 4% higher on Tuesday, after the morning bell. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

The stock experienced a 386% increase in user message count over 24 hours, as of Tuesday morning.

A law enacted by the Joe Biden administration in 2024 mandated that ByteDance divest TikTok’s U.S. assets due to national security concerns. With no deal being finalized, the incoming president, Donald Trump, extended the deadline after he assumed office.

Earlier in July, Trump pushed back the deadline for the sale of a controlling interest in TikTok's U.S. operations to September 17. The involvement of Oracle reflects its long-standing interest in data-driven platforms and cloud infrastructure, areas critical to TikTok's operations, the report noted.

On Monday, Trump hinted that a potential deal may be in the works for TikTok after trade negotiations in Madrid on Sunday, where U.S. Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer reportedly met with China on multiple issues, including the urgent deadline for TikTok.

On September 10, Oracle CEO Safra Catz stated that she expects booked cloud orders to exceed half a trillion dollars and that the company anticipates its cloud infrastructure revenue to reach $18 billion in fiscal year 2026.

Oracle stock traded over 89% in 2025 and over 85% in the last 12 months.

Also See: Why Did Adtran Stock Tumble 9% Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)