Advertisement|Remove ads.

Why Did SMX Stock Fall 30% Today?

- SMX announced a $111.5 million equity purchase agreement with Target Capital 1 on Monday.

- Target Capital will buy an $11.5 million convertible note with a 20% discount, while SMX also gains the option to sell up to $100 million in shares through a line of credit.

- Despite the steep intraday decline, retail sentiment on Stocktwits remained 'extremely bullish' over the past 24 hours.

SMX (Security Matters) PLC (SMX) shares were down nearly 30% on Monday, after the company announced an equity purchase agreement with Target Capital 1.

Trading in the shares on the Nasdaq was briefly halted early Monday. Notably, SMX was among the top trending tickers on Stocktwits.

Deal with Target Capital 1

SMX announced a $111.5 million equity purchase agreement with Target Capital 1, which it said will provide the company with an efficient and flexible source of funding and enable it to pursue its business development opportunities.

The company will also use part of the net proceeds to acquire bitcoin or another cryptocurrency, which will serve as a reserve asset for SMX.

Under the terms of the deal, Target Capital will purchase a convertible promissory note with a principal amount of $11.5 million, carrying a 20% original issue discount for a face value of around $14.4 million. The agreement also provides SMX with the option to sell up to $100 million of its ordinary shares through an equity line of credit.

SMX is not required to draw on the equity line, and the agreement places no limits on its operations. The transaction is expected to close around December 2.

How Did Stocktwits Users React?

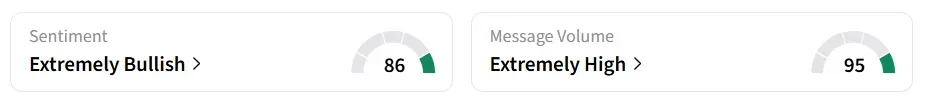

Despite the sharp intraday decline, retail sentiment on Stocktwits remained in the 'extremely bullish' territory over the past 24 hours, accompanied by 'extremely high' message volumes.

The stock has surged over the last couple of sessions after the company unveiled molecular-level identity markers for gold and the rare earth industry at the DMCC Precious Metals Conference in Dubai. The markers allow the minerals to carry their own proof of origin through every stage of processing.

It features SMX’s patented molecular-marking technology, which assigns a unique molecular identity to each piece of metal and links it to a secure digital record.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trump_and_hegseth_1_a0df8fad8f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2150094845_jpg_eb609b5387.webp)