Advertisement|Remove ads.

Why Did Trinity Biotech Stock Surge Nearly 50% In Premarket Today?

- Trinity posted a 32% sequential increase in third-quarter revenue to $14.3 million, driven by a $2.1 million increase in rapid HIV test sales.

- The company entered into new financing agreements with funds managed by Perceptive Advisors.

- The deal includes $5 million in new term-loan funding and up to $60 million in elective equitization capacity.

Trinity Biotech (TRIB) shares surged nearly 50% in premarket trading on Tuesday, after the company said it had secured an order for 9 million units of its TrinScreen HIV rapid diagnostic test.

The WHO-prequalified rapid diagnostic test is designed for high-volume screening programs and will be produced through the company’s recently approved outsourced manufacturing process. Trinity Biotech expects to fulfil the order across the fourth quarter of 2025 and the first quarter of 2026, with the contract set to support revenue growth.

Trinity Biotech also posted a 32% sequential increase in third-quarter revenue to $14.3 million, driven by a $2.1 million increase in rapid HIV test sales, while adjusted EBITDA improved to a $0.5 million profit from a $2.1 million loss in Q2.

The company said it continues to advance its transformation plan after securing key regulatory approvals, including WHO authorization to outsource production of its Uni-Gold HIV rapid test. These milestones are expected to drive efficiency gains and support rising adjusted EBITDA through the first half of 2026.

"Our operating and financial improvement in Q3 2025 was encouraging, in particular the achievement of positive Adjusted EBITDA. This gives us confidence that our Comprehensive Transformation Plan is on track and, when combined with our exciting innovation agenda, leaves the business well positioned for further progress in 2026,” said John Gillard, CEO of Trinity Biotech.

Trinity's Financing Plans

Trinity Biotech also entered into new financing agreements with funds managed by Perceptive Advisors to strengthen liquidity and improve capital structure flexibility.

The deal includes $5 million in new term-loan funding and up to $60 million in elective equitization capacity, which could lower debt and interest costs. The agreements also introduce equity-based settlement options for certain obligations, supporting Trinity Biotech’s long-term growth and investment plans.

How Did Stocktwits Users React?

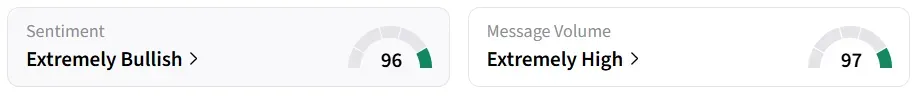

Retail sentiment flipped to 'extremely bullish' from 'extremely bearish' a day earlier, amid 'extremely high' message volumes.

One user sees $1.75 as a key resistance point.

Year-to-date, the stock has gained 43%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)