Advertisement|Remove ads.

Honeywell Stock Is Sliding Premarket Today – Two Moves Are Driving This Drop

- The company lowered FY25 revenue guidance following the reclassification of its Advanced Materials business as discontinued operations.

- Honeywell expects adjusted earnings per share between $9.70 and $9.80, down from a range of $10.60 to $10.70.

- Honeywell expects to take a one-time Q4 2025 charge in its Aerospace Technologies segment that will reduce GAAP sales by $310 million and operating income by $370 million.

Honeywell International Inc. (HON) shares fell nearly 3% in premarket trading on Monday after the company lowered its full-year 2025 adjusted sales and earnings outlook.

Honeywell now expects FY25 adjusted revenue of $37.5 billion to $37.7 billion, down from its prior forecast of $40.7 billion to $40.9 billion, following the reclassification of its Advanced Materials business as discontinued operations. The company exited the business following the spinoff of Solstice Advanced Materials (SOLS) on Oct. 30, 2025.

The company expects adjusted earnings per share between $9.70 and $9.80, down from a range of $10.60 to $10.70. The company said its fourth-quarter non-GAAP performance outlook remains intact.

Honeywell said that the new segment structure supports its automation-focused strategy ahead of the planned Aerospace spin-off in the second half of 2026.

It will report four segments: Aerospace Technologies, Building Automation, Process Automation and Technology, and Industrial Automation. The three automation segments will each include two business units, while reporting for Aerospace Technologies remains unchanged.

On the Flexjet-related litigation, Honeywell expects to take a one-time fourth-quarter 2025 charge in its Aerospace Technologies segment that will reduce GAAP sales by about $310 million and operating income by roughly $370 million. Any related settlements are expected to include one-time cash payments totaling around $470 million.

How Did Stocktwits Users React?

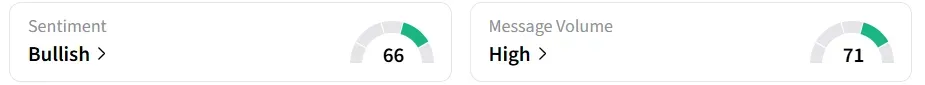

Despite the intraday losses, retail sentiment on Stocktwits remained in the 'bullish' zone over the past 24 hours, amid 'high' message volumes.

One user said that the revenue revision was expected.

Year-to-date, HON stock has declined 8%.

Read Also: CWAN Stock Surges Pre-Market On $8.4B Buyout Offer – Retail Expects Go-Shop Window To Fuel More Bids

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)