Advertisement|Remove ads.

Why IBRX Stock Is One Of The Biggest Pre-Market Movers Today

- The trial compares Bacillus Calmette-Guérin (BCG) therapy alone with BCG combined with ANKTIVA.

- Preliminary analysis showed that ANKTIVA plus BCG significantly extended the duration of complete response in BCG-naïve cancer patients.

- ImmunityBio plans to submit a biologics license application to the FDA by the end of 2026.

ImmunityBio, Inc. (IBRX) shares jumped 24% in premarket trading on Friday after the company reported a faster than expected enrollment for its QUILT-2.005 bladder cancer drug trial.

The company said that enrollment has surpassed internal expectations and is now more than 85% complete, with full enrollment of the planned study population expected by the second quarter of 2026.

Based on current progress, ImmunityBio plans to submit a biologics license application to the U.S. Food and Drug Administration (FDA) by the end of 2026.

“We look forward to the final accrual of this important registrational randomized trial in patients with BCG-naïve non-muscle-invasive bladder cancer, which represents a substantial proportion of newly diagnosed bladder cancer cases. The interim analysis is encouraging and consistent with findings in the approved BCG-unresponsive setting, where the duration of complete response has exceeded 47 months,” said Patrick Soon-Shiong, M.D., Founder, Executive Chairman, and Global Chief Medical and Scientific Officer of ImmunityBio.

Based on current progress, ImmunityBio plans to submit a biologics license application to the FDA by the end of 2026.

What Is The Trial About?

The QUILT-2.005 is a clinical trial for Bacillus Calmette-Guérin (BCG) naïve non-muscle-invasive bladder cancer (NMIBC) that compares standard BCG therapy alone versus BCG combined with ANKTIVA, an Interleukin-15 (IL-15) receptor agonist. IL-15 is an immune system protein that helps develop and activate key cells that work to destroy cancer cells.

In 2023, the FDA requested an interim analysis of the randomized trial to evaluate the added benefit of ANKTIVA when combined with BCG, focusing on complete response rates and the durability of response versus BCG alone.

The analysis showed that ANKTIVA plus BCG significantly extended the duration of complete response in BCG-naïve NMIBC patients. At six months, 85% of patients receiving the combination maintained a complete response, compared with 57% in the BCG-only group. At nine months, response rates were 84% with combination therapy versus 52% with BCG alone.

How Did Retail React?

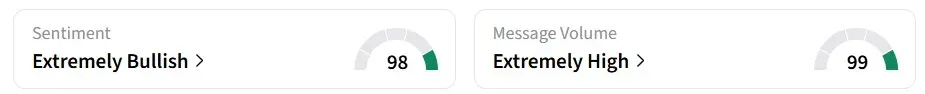

Retail sentiment for IBRX on Stocktwits remained in the ‘extremely bullish’ zone over the past 24 hours, amid ‘extremely high’ message volumes.

One user was bullish about the company’s potential.

Another user saw the stock as a long-term runner.

Over the past year, the stock has gained more than 60%.

Read also: RKLB Stock Is On Track For Record Open – Here’s What’s Driving The Rally

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)