Advertisement|Remove ads.

Why Is MU Stock Up 4% In Premarket Today?

- Micron has committed $24 billion to build an advanced fab in Singapore.

- The company is also eyeing a manufacturing facility in Taiwan.

- Micron’s stock has quadrupled in the past 12 months amid a tight supply of memory chips and burgeoning demand from AI data centers.

Micron Technology, Inc’s (MU) stock surged 4% in early premarket trading on Tuesday, after the memory chip-maker announced a major investment to expand its manufacturing operations in Singapore.

The company will invest $24 billion over the next decade to build an advanced wafer fabrication facility for NAND memory chips. The facility will complement a separate packing plant for HBM chips in the country, that it due to go live next year.

Last week, Micron said it was in talks to buy a fabrication site from Powerchip in Taiwan for $1.8 billion, which would boost its DRAM wafer output.

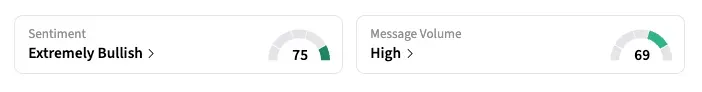

On Stocktwits, retail sentiment for MU remained in the ‘extremely bullish’ zone, unchanged from the previous day, amid ‘high’ message volume.

Memory chip stocks, including Micron, SanDisk, and Western Digital, have seen significant gains in recent months owing to concerns of tight supply amid burgeoning demand from AI data centers. Stocktwits recently published a concise explainer on how investors should view the memory industry’s current upswing.

Micron's share price has more than quadrupled in the past 12 months.

Currently, 37 of 43 analysts recommend ‘Buy’ or higher, four recommend ‘Hold,’ and two recommend ‘Sell,’ per Koyfin. Their average price target of $354.21, however, is 9% below the stock’s last closing price.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)