Advertisement|Remove ads.

Why Is Vertiv Stock Rising Today? Here’s What The CEO Said About Capacity Expansion And Innovation Pipeline

Vertiv Holdings (VRT) CEO Giordano Albertazzi on Wednesday highlighted the company’s efforts to boost capacity and speed up operations in data centers designed for AI technology.

“We are strategically investing in capacity expansion and accelerating our innovation pipeline to capitalize on unprecedented data center growth, particularly in AI-enabled infrastructure,” Albertazzi stated in the company’s second-quarter (Q2) earnings statement.

Vertiv stock traded over 5% higher in Wednesday’s premarket.

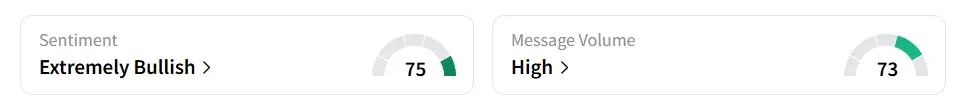

On Stocktwits, retail sentiment toward the stock jumped to ‘extremely bullish’ (75/100) from ‘neutral’ territory the previous day amid ‘high’ (73/100) message volume levels in 24 hours.

The stock experienced a 53% increase in message count over the last 24 hours.

Stocktwits users heaped praise on the earnings.

Vertiv delivered strong results in Q2, benefiting from increasing demand in the data center market.

The company’s Q2 revenue increased 35% year-on-year (YoY) to $2.64 billion, beating the analysts’ consensus estimate of $2.36 billion, as per Fiscal AI data.

Adjusted earnings per share (EPS) of $0.95 also exceeded the consensus estimate of $0.84.

Operating profit surged by 32% to $442 million. Vertiv’s backlog stood at $8.5 billion with a book-to-bill ratio of approximately 1.2x.

The company also raised its full-year guidance as orders and revenue momentum continue to build. It now expects 2025 organic sales growth of 24%, up from the previous 18% outlook.

Vertiv sees 2025 adjusted EPS of $3.80, up from the previous $3.55 guidance.

The company held $1.64 billion in cash and equivalents as of June 30.

Vertiv stock has gained over 25% year-to-date and over 95% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233660867_jpg_2fb83a8353.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AVAV_Aerovironment_resized_16c17bbfe3.jpg)