Advertisement|Remove ads.

Why Jim Cramer Thinks META Can Be The Biggest Winner In A ‘Power Gating’ Scenario

- As electricity demand continues to grow, data centers are under pressure to control how much power they use.

- Power gating helps reduce wasted energy, cut operating expenses, and keep hardware working longer.

- With rivals facing similar energy and labor bottlenecks, Meta may find more flexibility to slow its own infrastructure spending.

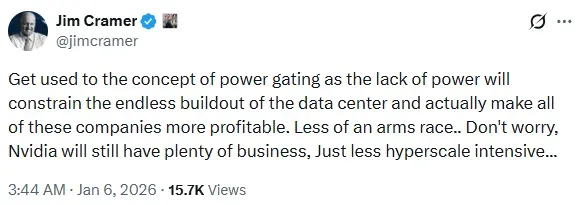

CNBC’s Jim Cramer said power constraints are beginning to reshape how companies think about data center expansion, and one potential beneficiary of tighter power economics could be Meta Platforms Inc. (META)

In a post on the X platform, Cramer stated that Investors are increasingly focused on “power gating,” a strategy that limits energy usage and forces firms to prioritize efficiency over scale at any cost.

Power Gating In Data Centers

As electricity demand continues to grow, data centers are under pressure to control how much power they use. One effective approach is power gating, which means turning off IT equipment when it is not needed. Using this method helps reduce wasted energy, cut operating expenses, keep hardware working longer, and contribute to overall sustainability efforts.

According to Cramer, the concept helps steer companies away from unchecked spending toward tighter discipline. The result could be slower construction of massive server farms but stronger margins for companies that adapt quickly.

Cramer remarked that the dynamic marks a cooling of the once-frenzied race to build ever-larger data centers, especially as electricity availability and infrastructure limits become more pressing. While demand for advanced chips remains intact, hyperscale projects may no longer dominate capital spending plans.

How Meta Platforms Will Benefit

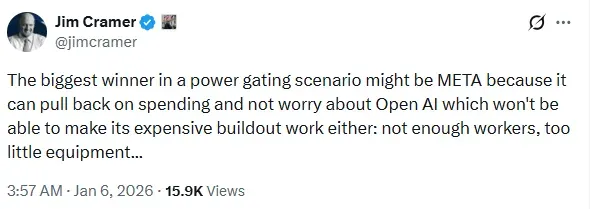

Meta can gain comparatively as it can afford to slow its infrastructure spending without falling behind on its AI goals, while its competitors, including OpenAI, won't be able to match a large-scale buildout without trimming expenses.

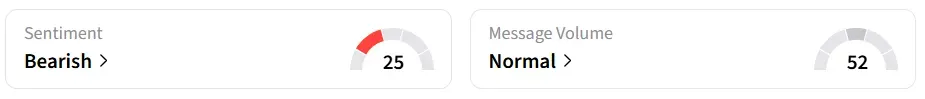

Meta’s stock inched 0.2% lower in Tuesday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘normal’ message volume levels.

As an example for investors favouring companies with efficiency over increased spending, Cramer pointed to firms such as Honeywell (HON), Dover (DOV), and DuPont de Nemours (DD) outperforming. These companies are less exposed to data center spending cycles and more aligned with automation, materials, and efficiency upgrades.

META stock has gained over 4% in the last 12 months.

Also See: This Space Stock Logs Explosive Start To 2026 — Erases Most Of 2025 Losses In Just 2 Days

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)