Advertisement|Remove ads.

Why Retail Investors Are Turning Sharply Bullish On Apellis Pharmaceuticals

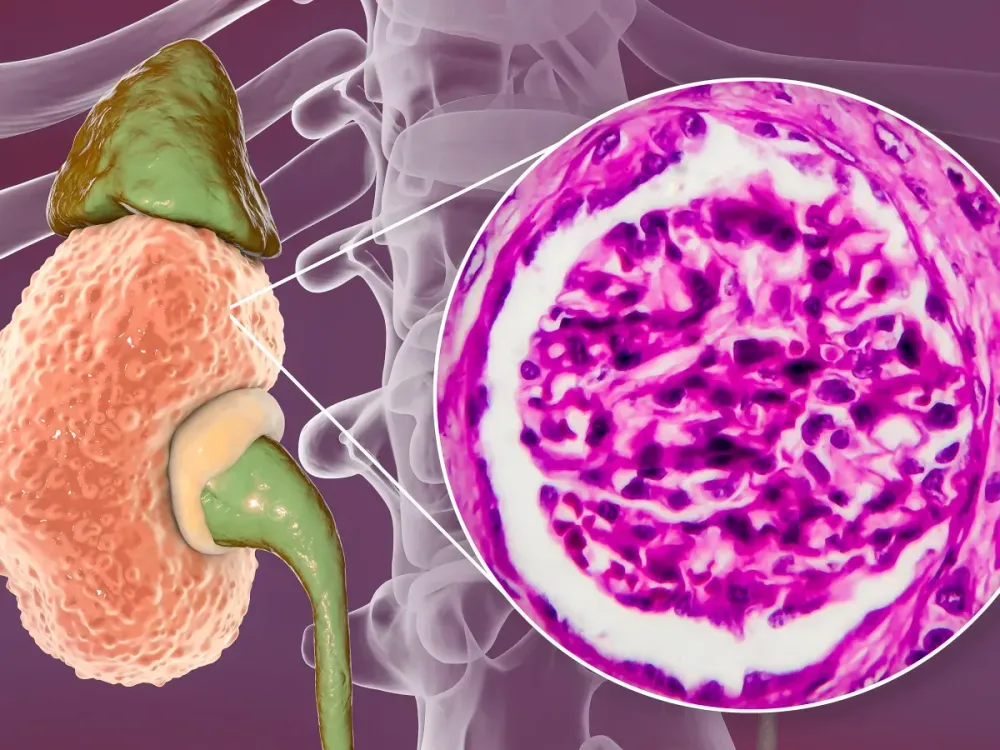

Retail buzz around Apellis Pharmaceuticals intensified on Monday after the FDA approved Empaveli, clearing the way for its use in treating two rare kidney diseases that often lead to kidney failure.

The drug is now approved for patients 12 and older with C3G and IC-MPGN, which are conditions that affect 5,000 people in the U.S.

The decision was backed by data from the Phase 3 Valiant trial, where patients on Empaveli saw a 68% drop in protein levels in their urine, a key sign of kidney stress, along with steady kidney function and signs that harmful C3 deposits were being cleared.

The label also includes patients with post-transplant recurrence of C3G.

The FDA decision comes amid a flurry of Wall Street updates on Apellis. Earlier this month, Baird raised its price target on Apellis to $50 from $47, updating its model ahead of second-quarter earnings and noting competitive developments in the C3G space.

Morgan Stanley and BofA also raised their price targets, now at $26 and $24, respectively.

BofA maintained a ‘Neutral’ rating and noted that Apellis has not provided sales guidance for Syfovre, its treatment for geographic atrophy. Morgan Stanley maintained an ‘Equal Weight’ rating and cited the royalty purchase agreement with Sobi.

Apellis recently struck a $300 million royalty deal with Sobi, selling 90% of its future ex-U.S. royalties from Aspaveli, its treatment for a rare blood disorder called paroxysmal nocturnal hemoglobinuria (PNH), to strengthen its cash position.

Apellis will receive $275 million upfront and may earn another $25 million if Aspaveli is approved for C3G and IC-MPGN in Europe.

On Stocktwits, retail sentiment for Apellis was ‘extremely bullish’ amid a 2,350% surge in 24-hour message volume.

Apellis’ stock has declined 43.5% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)