Advertisement|Remove ads.

Big Bull Run: Waaree Energies Shares Hit Fresh High; Market Cap Crosses ₹1 Lakh Crore

Waaree Energies shares have surged 7% on Thursday, hitting a fresh all-time high, and adding to the 75% rally over the last six months. Its market capitalisation now stands above ₹1 lakh crore.

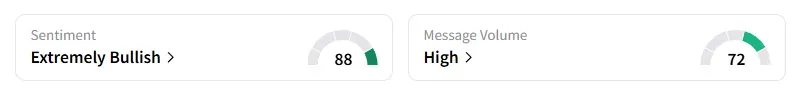

It was also the top trending stock on Stocktwits at the time of writing this. And retail sentiment had moved from ‘bullish’ to ‘extremely bullish’ amid ‘high’ message chatter.

What’s Driving The Rally?

Waaree Energies has been in an uptrend this week, rising over 10% since its subsidiary, Waaree Solar Americas, received a large international order to supply 452 MW of solar modules to a leading US-based renewable energy developer.

Waaree Energies has a large order book worth around ₹49,000 crore as of June 2025, of which nearly 60% comes from overseas contracts. India's largest manufacturer and exporter of solar PV modules has been expanding manufacturing capacity in both the US and India.

Bullish Call On Waaree Energies

Wealth Guru recommended buying above ₹3,605 for target prices of ₹3,700, ₹4,000, with a stop loss at ₹3,510.

Strong Fundamentals

The Mumbai-based solar company reported a stellar June quarter (Q1 FY26). It reiterated its EBITDA guidance of ₹5,500–₹6,000 crore for FY26, led by strong demand, capacity expansion, and ramp-up of the solar cell plant.

Analysts expect rising power needs from AI and energy storage to support growth. Export revenue share is likely to increase in Q2 as a large part of the orders were exported. And the US tariff impact may be passed through for most orders; doubling its US capacity to 3.2GW shall reduce the impact on exports, according to brokerage firm, Nuvama.

Waaree Energies shares have risen nearly 30% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)