Advertisement|Remove ads.

Will Fed Hold Rates This Week? Retail Traders Mostly Expect Pause — But Some Eye Cuts Amid Geopolitical Tensions

The Federal Reserve Open Market Committee (FOMC), the central bank’s rate-setting committee, kicks off a two-day meeting on Tuesday.

The decision will be accompanied by the release of the dot-plot chart, which summarizes the central bank officials' rate outlook, and the updated Summary of Economic Projections (SEP).

Chair Jerome Powell will round off the Fed meeting with a press conference, during which he will discuss the rationale behind the rate decision and the interest rate outlook.

The Fed meeting is a market-moving event, with traders eyeing the rate decision, the SEP as well as the dot-plot curve as they contemplate their next market moves.

The Invesco QQQ Trust (QQQ) ETF and the SPDR S&P 500 ETF (SPY), exchange-traded funds (ETFs) that track performances of the Nasdaq 100 and the S&P 500 indices, respectively, are up 4.70% and 3.1%, for the year.

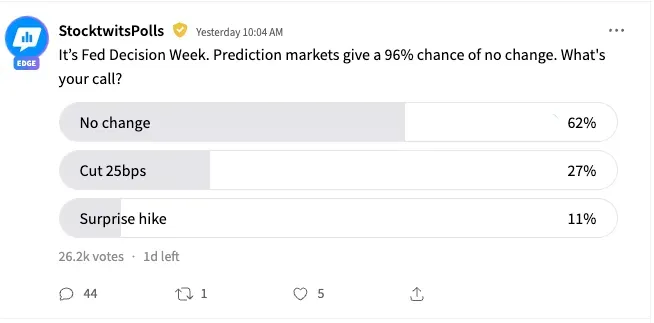

By pointing out that the predictions market gave a 96% chance for a “no change” stance, a Stocktwits poll asked users about their call on the rate decision.

The poll, which received responses from 26,200 users, showed that retail users on the platform aligned with the thinking of the predictions market.

Most users (62%) positioned for no change in the Fed funds rate, leaving it at the current 4.25%-4.50%. The Fed rate serves as the benchmark for many other rates in the U.S. financial system. It refers to the rate that banks charge each other for lending excess cash from their overnight reserve balance.

Over a quarter (27%) expected a 25 basis-point cut, while 11% factored in a surprise hike.

The CME FedWatch Tool, which is constructed based on the expectations of futures traders, showed a 99.9% probability of a pause decision.

Recent data points have been mixed, with the May inflation report coming in tamer than expected and a regional manufacturing report released Monday showing a steeper-than-expected contraction.

On the other hand, the May non-farm payrolls report and a recent consumer sentiment report underlined the economy’s resilience.

Powell and his fellow central bank officials have signaled that they prefer to err on the side of caution and will stick to their data-dependent stance. The Trump tariff flux could be another factor keeping the central bank on the sidelines, at least until more clarity on the final levies is gained.

President Donald Trump has publicly opposed the Fed’s approach and has applied political pressure on Powell & co to lower rates by a whole percentage point.

WisdomTree Senior Economist Jeremy Siegel said he does not anticipate significant movement in the median forecast or Chair Powell’s messaging. However, he expects the central bank to cut by the third quarter, leaving rates at 3.5% by the end of the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)