Advertisement|Remove ads.

Will Trump Take Control Of Greenland? Here's What Bettors On Prediction Markets Think

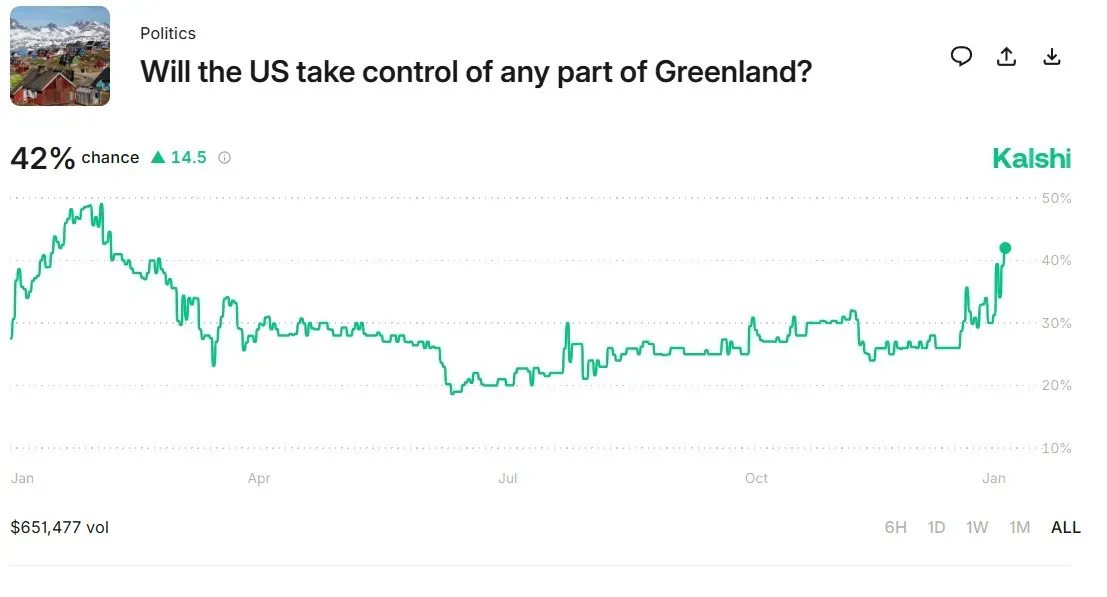

- Data from Kalshi shows users think there is a 42% chance that the United States will take control of any part of Greenland by the end of President Trump’s tenure in January 2029.

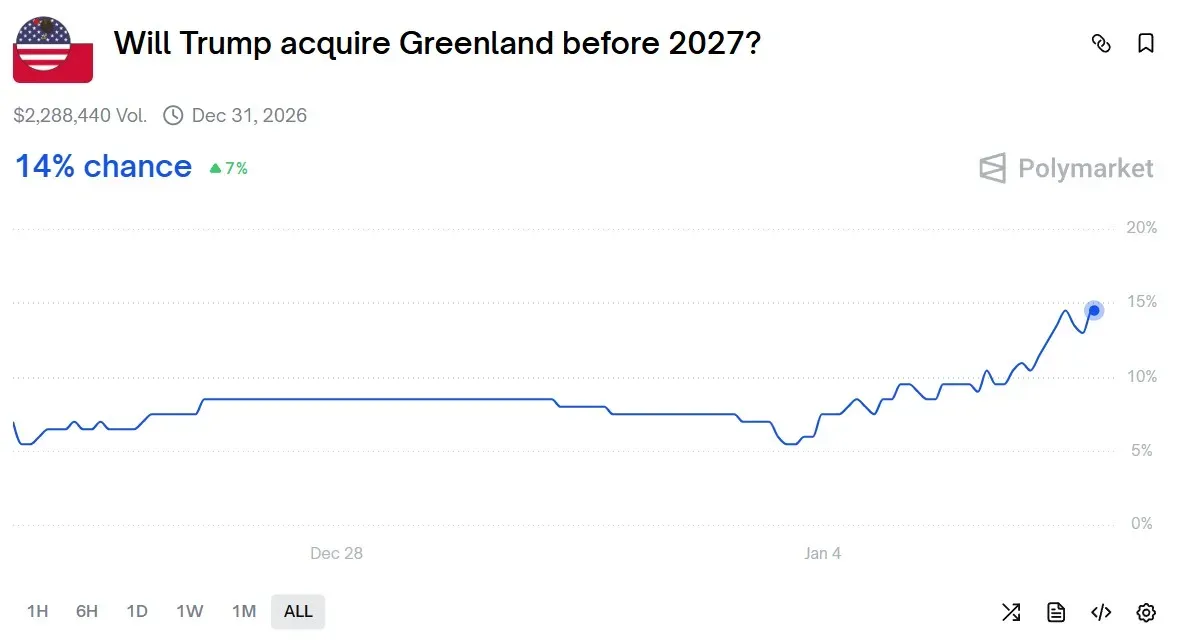

- On Polymarket, bettors think there is a 15% chance that the Trump administration acquires Greenland before 2027.

- On Tuesday, White House Press Secretary Karoline Leavitt stated that President Trump and his team are discussing a range of options to pursue the goal of acquiring Greenland.

Prediction markets are buzzing with bets on whether President Donald Trump’s administration will take control of any part of Greenland over the coming years.

Data from popular prediction markets Kalshi and Polymarket show that bets regarding the Trump administration’s bid on Greenland are now worth nearly $3 million. While Kalshi volumes show bets worth more than $651,000, Polymarket bets had reached a total of nearly $2.3 million at the time of writing.

What Are The Prediction Markets Saying?

Data from Kalshi shows users think there is a 42% chance that the United States will take control of any part of Greenland by the end of President Trump’s tenure in January 2029.

On Polymarket, bettors think there is a 14% chance that the Trump administration acquires Greenland before 2027. Both bets require an official announcement from the U.S.

Overall, though, bettors on both prediction platforms think there is a low probability that Greenland will come under the sovereign control of the U.S.

Amid the growing chatter around Greenland, Polymarket has come under fire for not paying out bets on the U.S. raid on Venezuela, highlighting the risks involved in betting on critical geopolitical events where there is room for subjective interpretation.

Trump Administration’s Statements On Greenland

The bets come amid an increase in the frequency of statements about Greenland from the Trump administration.

White House Press Secretary Karoline Leavitt stated on Tuesday that President Trump and his team are discussing a range of options to pursue the goal of acquiring Greenland, according to a NBC News report.

“President Trump has made it well known that acquiring Greenland is a national security priority of the United States, and it’s vital to deter our adversaries in the Arctic region,” Leavitt said.

In a joint statement by foreign ministers of Nordic countries, the allies said that “Greenland belongs to its people.” “It is for Denmark and Greenland, and them only, to decide on matters concerning Denmark and Greenland,” they said.

Meanwhile, U.S. equities were mixed in Wednesday morning’s trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up by 0.09%, the Invesco QQQ Trust ETF (QQQ) rose 0.37%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) declined 0.36%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260984359_jpg_566af2429c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Alphabet_jpg_b0657d669f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Brian_Armstrong_Coinbase_60d65adb96.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_moderna_logo_resized_c72083ff97.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245685477_jpg_ce08eb96cb.webp)