Advertisement|Remove ads.

Williams-Sonoma Stock Rises On S&P 500 Addition Ahead of Q4 Earnings: Retail’s On The Sidelines

Shares of Williams-Sonoma (WSM) rose 3.28% on Friday after the company’s upcoming inclusion in the S&P 500 ahead of its fourth-quarter earnings, but retail sentiment lagged the move.

Williams-Sonoma, whose brands include Pottery Barn, West Elm, and GreenRow, will join four other companies in the index by the end of the month. The index is a benchmark for some of the largest companies by market capitalization, but it also selects companies based on sector diversification, among other parameters.

Williams-Sonoma is scheduled to report its fiscal fourth-quarter earnings on Wednesday. Wall Street analysts expect Williams-Sonoma to post earnings per share of $2.89 on revenues of $2.34 billion, according to Stocktwits data.

Last week, Wedbush raised the firm's price target to $190 from $175 with a ‘Neutral’ rating, The Fly reported, saying the firm remains sidelined on Williams-Sonoma going into Q4 earnings.

According to the firm, Industry/3P data and competitor read-throughs show an upside to Q4 estimates, but its near-term outlook faces uncertainty from tariffs and softer consumer sentiment.

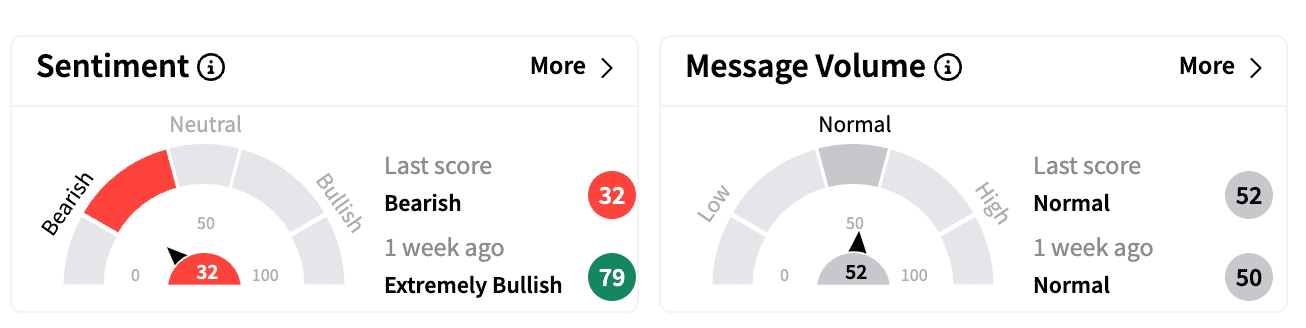

Sentiment on Stocktwits ended in the ‘bearish’ zone on Friday, one watcher was upbeat about the recent performance of several retail companies.

In January, Williams-Sonoma’s CEO Laura Alber sold $9.35 million worth of shares, according to Investing,com, which reported Alber has direct ownership of 944,666 shares in addition to 33,106 shares indirectly through a managed account.

Williams-Sonoma stock is up 14% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206312585_jpg_1a7c050dff.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205716060_jpg_b54d4e2d13.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1157193929_jpg_57df32610c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_32b8924ac2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)