Advertisement|Remove ads.

WisdomTree, Lyell Immunobiopharma, DexCom Among Stocks Retailers Are Most Bullish In Friday's Premarket

WisdomTree, Inc. ($WT)

Shares of WisdomTree, which offers a suite of exchange-traded and blockchain technology products, reported third-quarter earnings per share (EPS) of $0.18 compared to $0.10 per share a year-ago. This beat the consensus estimate of $0.18, according to Yahoo Finance.

The shares climbed 4.50% to $10.85 as of 9:00 am ET, in premarket trading.

WisdomTree’s assets under management at the end of the third quarter was $112.6 million, up from $109.7 million at the end of the second quarter. Operating revenue came in at $109.5 million compared to the $90.4 million reported for a year earlier. This was slightly shy of the consensus estimate of $110.07 million.

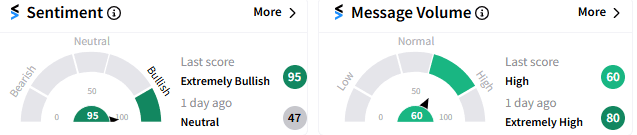

Retail sentiment was ‘extremely bullish’ (95/100) with message volume reducing from a day ago, yet at ‘high.’

Lyell Immunopharma, Inc. ($LYEL)

Small-cap Lyell Immunopharma, a clinical-stage CART T-cell therapy biotech, said late Thursday that it has entered into a definitive agreement to acquire privately-held ImmPACT Bio USA Inc for $30 million in cash and 37.5 million in stock.

Through the acquisition, Lyell Immunopharma will acquire worldwide rights to ImmPACT’s pipeline. The company will prioritize the development of IMPT-314 for treating B-cell lymphoma, a type of blood cancer.

ImmPACT shareholders are also eligible to receive contingent consideration of 12.5 million of Lyell Immunopharma stock as milestone-based payment as well as royalties on net sales.

The deal has been vetted by the board of both companies and is expected to close in the fourth quarter.

The stock gained 0.94% to $1.10 in premarket trading.

DexCom, Inc. ($DXCM)

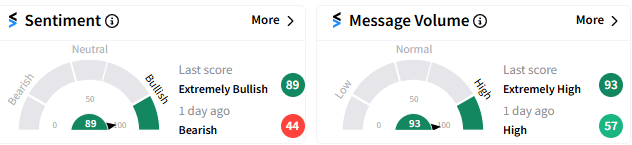

Glucose monitoring device manufacturer Dexcom’s shares fell in premarket trading but retail sentiment remains ‘extremely bullish.'

DexCom’s third-quarter non-GAAP EPS came in at $0.45 compared to the consensus estimate of $0.43. Revenue rose 2% year-over-year from $975 million to $994.2 million. Analysts, on average, estimated a modest $990.44 million for the quarter.

The double beat is a welcome relief after the company missed top-line expectations in the second quarter.

Dexcom announced a management transition as Teri Lawver, who serves as chief commercial officer, is set to retire by the year-end. Sayer will assume her responsibilities as the company begins a search for a replacement.

Read Next: Dexcom Stock Plunges Despite Q3 Beat But Retail Sentiment Improves

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219301415_jpg_7634ca599c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_instacart_jpg_a510adb6d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235797357_jpg_2c6f3265ce.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_David_Soloimon_jpg_72836d8f0c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)