Advertisement|Remove ads.

Wolfspeed, Nvidia, Gilead, SLB, Corning: What Sparked Heavy After-Hours Trading In These 5 Stocks?

U.S. stocks reversed course on Monday, although trading was characterized by volatility amid the uncertainties that continue to abound. IT and consumer discretionary gained some ground, helping to offset the weakness or sluggish performances of most other sectors.

Nevertheless, the Nasdaq Composite Index hit an all-time intraday and closing high.

Even as the market deals with the uncertainty around the Federal Reserve’s next rate move, the following stocks saw substantial trading volume in the after-hours:

Wolfspeed, Inc. (WOLF)

After-hours move: +57.73%

Trading volume: 26.43 million

The increased trading volume in Wolfspeed stock was accompanied by an after-hours jump in the shares of the company, which manufactures wide-bandgap semiconductors, focusing on silicon carbide and gallium nitride materials.

Wolfspeed said Monday after the market close that the company has received Court approval of its Plan of Reorganization, and it is slated to file a Chapter 11 bankruptcy protection claim over the next several weeks.

Retail users of Stocktwits cheered the development, with sentiment toward Wolfspeed stock improving to ‘extremely bullish’ levels (86/100) by late Monday from ‘neutral’ a day ago. The message volume on the stream picked up pace to ‘extremely high’ levels.

Wolfspeed stock has lost over 81% year-to-date (YTD).

Nvidia Corp. (NVDA)

After-hours move: -0.07%

Trading volume: 6.99 million

Nvidia’s stock rose 0.77% on Monday despite an analyst’s price target cut. Citi analyst Atif Malik reduced the price target for the stock to $200 from $210 and maintained a ‘Buy’ rating, the Fly reported. The analyst attributed his tempered opinion to Broadcom’s (AVGO) comments concerning the strong growth of its artificial intelligence (AI) chips. As such, he reduced his 2026 GPU sales estimate for Nvidia by 4%.

The research firm expects a $12 billion hit to Nvidia's GPU sales from Broadcom’s XPU deals.

On Monday, the Jensen Huang-led company also voiced its opinion about the GAINS AI Act, which was proposed by U.S. Senators last week to regulate AI GPU shipments to adversaries. The company reiterated that the U.S. will always be its primary market but lashed out at the bill. “While it may have good intentions, this bill is just another variation of the AI Diffusion Rule and would have similar effects on American leadership and the U.S. economy,” it said.

After the market closed, Nvidia filed with a 144 statement with the SEC regarding Huang’s intention to sell 75,000 shares. It also filed a Form 4, communicating the sale of 225,000 Nvidia shares last Thursday following the exercise of options.

Retail sentiment toward Nvidia’s stock stayed ‘bearish’ (32/100) and the message volume was at ‘low’ levels.

The stock has gained 25% year-to-date.

Gilead Sciences, Inc. (GILD)

After-hours move: unchanged

Trading volume: 6.97 million

The increased trader interest in Gilead stock was despite the lack of any meaningful, fresh catalysts. Last Friday, the company announced a partnership with the U.S. State Department and the United States President’s Emergency Plan for AIDS Relief (PEPFAR) to deliver lenacapavir, its twice-yearly injectable HIV-1 capsid inhibitor, for the prevention of HIV as pre-exposure prophylaxis (PrEP).

It also broke ground at the new Pharmaceutical Development and Manufacturing (PDM) Technical Development Center (NTDC) at the company’s Foster City, California headquarters. This is part of the company’s proposed $32 billion investment in the U.S. through 2030.

On Stocktwits, retail sentiment toward Gilead stock tempered to ‘neutral’ (54/100) from ‘bullish’ a day ago. The message volume remained ‘low.’

The shares are up over 27% YTD.

SLB Ltd. (SLB)

After-hours move: unchanged

Trading volume: 6.59 million

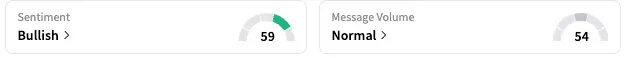

Oilfield services company SLB was on investors’ radar amid the ongoing volatility in oil prices. SLB stock, which is down 4.5% this year, drew ‘bullish’ sentiment (59/100) from retailer users of Stocktwits, up from ‘neutral’ a day ago. The message volume remained at ‘normal’ levels.

Corning, Inc. (GLW)

After-hours move: +0.25%

Trading volume: 5.92 million

New York-based Corning, a maker of optical fibers and cables, and hardware and equipment products, has seen its shares rise over 54% this year.

The stock may have evinced interest ahead of Apple’s iPhone 17 launch event scheduled for Tuesday. In early August, Apple announced a new $2.5 billion commitment to produce all of the cover glass for iPhone and Apple Watch in Corning’s Harrodsburg, Kentucky, manufacturing facility.

Retail sentiment toward Corning stock has remained ‘neutral’ (49/100) and the message volume stayed ‘high.’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2261646866_jpg_de6ca7bdf0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/iran_fm_iaea_chief_rafael_mariano_grossi_jpg_79ef4dc11f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_qualcomm_CEO_OG_jpg_7352181faa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)