Advertisement|Remove ads.

Xeris Biopharma Stock Soars To Nearly 4-Year High On Strong 2025 Outlook, Retail Bulls Charge In

Shares of Xeris Biopharma Inc. surged more than 9.5% on Thursday, reaching their highest level since June 2021, driven by a better-than-expected revenue forecast for 2025 that fueled investor optimism.

The rally came despite a slightly wider-than-expected quarterly loss, with retail sentiment increasingly bullish following the earnings release.

Xeris reported an adjusted fourth-quarter loss of $0.03 per share, narrowly missing Wall Street expectations of a $0.02 loss.

However, revenue for the period was $60.01 million, exceeding the consensus estimate of $58.54 million.

The company's full-year guidance emerged as the key driver of market enthusiasm. Xeris expects 2025 revenue of $255 million to $275 million, significantly higher than the $239.77 million analysts had expected.

CEO John Shannon described 2024 as an "exceptional" year, as revenue surpassed $203 million to a record high.

CFO Steven Pieper said record quarterly revenue of more than $60 million in Q4 contributed to a positive cash flow of $2 million and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of over $8 million.

He added that the 2025 revenue outlook represents more than 30% growth at the midpoint.

Xeris currently markets three key products: Recorlev for endogenous Cushing's syndrome, Gvoke for severe hypoglycemia, and Keveyis for primary periodic paralysis.

It is also advancing a pipeline of development programs, led by XP-8121, a Phase 3-ready, once-weekly subcutaneous injection for hypothyroidism, alongside several early-stage programs leveraging its technology platforms.

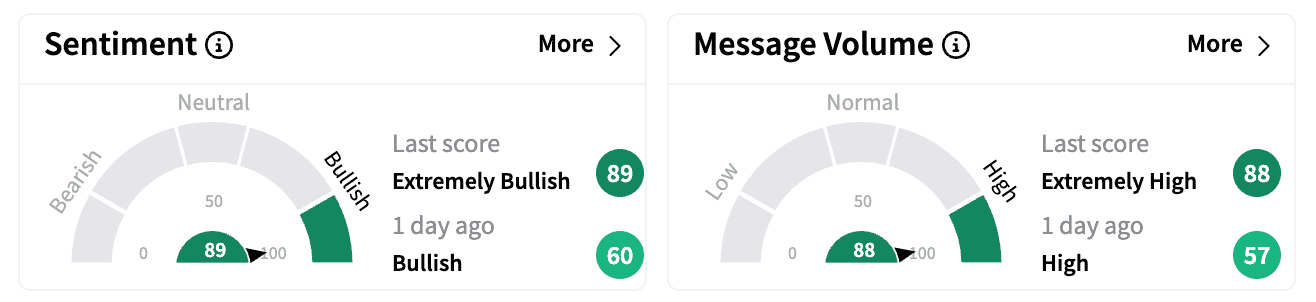

On Stocktwits, sentiment for Xeris turned 'extremely bullish' (89/100) and reached its highest score in a year, with message volume surging by 780% in the 24 hours to Thursday's close.

One user noted that the stock's long period of stagnation, "like 40 qtrs in the desert," had finally given way to momentum.

Another speculated about the possibility of a buyout, suggesting that Xeris could attract an acquisition offer by the end of the year.

Short interest in Xeris last stood at 6.9%, according to Koyfin data. The company's stock, which was falling after-hours on Thursday, has gained nearly 22% since the start of the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)