Advertisement|Remove ads.

KFC Parent Yum! Brands' Stock Rises Despite Q3 Miss: Retail Hungry For More

Yum! Brands, Inc. ($YUM) shares rose nearly 2% on Tuesday even as the firm reported its third-quarter results that saw earnings and revenue miss Wall Street expectations.

Revenue rose 7% year-over-year (YoY) to $1.83 billion but fell short of an estimate of $1.9 billion. Similarly, adjusted earnings per share (EPS) came in at $1.37 versus an estimate of $1.41.

The company’s KFC and Pizza Hut divisions saw same-store sales decline of 4% YoY. Worldwide sales fell 2% during the quarter.

However, the Taco Bell division witnessed a 4% rise in same-store sales.

CEO David Gibbs said while sales have been impacted by pressures relating to geopolitical conflicts and challenged consumer sentiment, the firm’s brands are “positioned for unstoppable growth.”

“Taco Bell U.S. significantly outperformed QSR competition with 4% same-store sales growth, and KFC International grew units an impressive 9% year-over-year. KFC International's unit openings spanned 64 countries this quarter, and year-to-date gross openings are up nearly 150 units year-over-year,” he said.

KFC’s operating profit fell 2% YoY to $339 million during the quarter while operating margin declined 6.1 percentage points to 43.1%. Taco Bell operating profit rose 11% YoY to $251 million while operating margin improved marginally to 37%.

Pizza Hut witnessed a 6% YoY fall in its operating profit to $91 million while operating margin fell 2 percentage points to 38.3%.

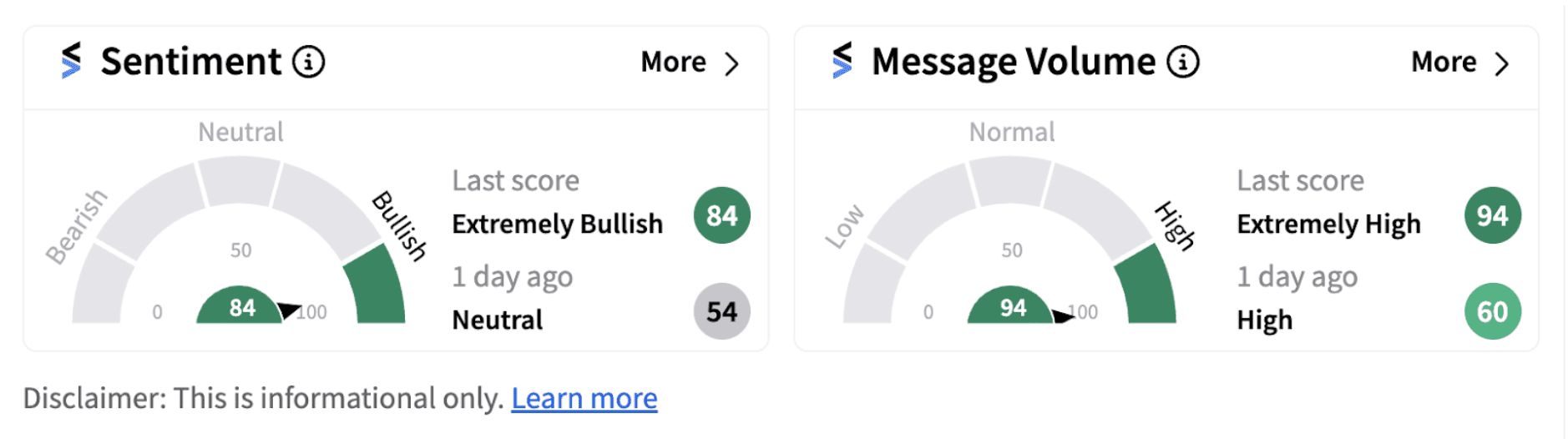

Following the announcement, retail sentiment on Stocktwits jumped into the ‘extremely bullish’ territory (84/100) from ‘neutral’ a day ago, accompanied by ‘extremely high’ message volume.

Yum! Brands’ sentiment meter as of 10:08 a.m. ET on Nov. 5, 2024 | Source: Stocktwits

Shares of the firm have gained over 4% on a year-to-date basis, significantly underperforming the benchmark U.S. indices.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)