Advertisement|Remove ads.

Zscaler Stock Jumps Premarket After Beat-And-Raise Q2: Retail Optimism Abounds

Zscaler, Inc. (ZS) stock climbed in Thursday’s premarket after the cybersecurity vendor announced forecast-beating quarterly results and issued upbeat forward guidance.

The San Jose, California-based company reported adjusted earnings per share (EPS) of $0.78 for the second quarter (Q2) of the fiscal year 2025. This compares to the year-ago’s EPS of $0.63 and the Finchat-compiled consensus of $0.69.

Revenue grew 23% year over year (YoY) to $647.9 million, exceeding the mean analysts’ estimate of $635.35 million.

The headline numbers also came in ahead of the guidance issued in early December that modeled EPS and revenue of $0.68 to $0.69 and $633 million to $635 million, respectively.

Zscaler Chairman and CEO Jay Chaudhry said, “Growing adoption of Zero Trust and [artificial intelligence] AI is driving strong demand for our platform, resulting in yet another strong quarter that exceeded our guidance on both top and bottom line.”

The company’s Zero Trust cloud-native platform implements a zero-trust security strategy, which operates on the principle that no user, device, or application is trusted by default.

Among user metrics, deferred revenue climbed 25% YoY to $1.88 billion, slightly slower than the 27% growth in the first quarter (Q1). Calculated billings increased 18% to $742.69 million versus the first quarter’s 13% growth.

The company ended the quarter with a cash position of $2.88 billion.

Looking ahead, Zscaler guided third-quarter (Q3) adjusted EPS and revenue in the range of $0.75 to $0.76 and $665 million to $667 million, respectively, compared to the consensus estimate of $0.74 and $666.22 million.

The company raised its fiscal year 2025 adjusted EPS guidance to a range of $3.04 to $3.09, from $2.94 to $2.99 and revenue guidance to a range of $2.64 billion to $2.654 billion from $2.623 billion to $2.643 billion.

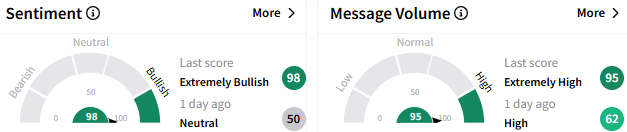

On Stocktwits, retail sentiment toward Zscaler stock improved to ‘extremely bullish’ (98/100) from the ‘neutral’ mood that prevailed a day ago. The message volume perked to ‘extremely high’ levels.

A bullish watcher shared a technical chart and said the next stop is at the $212 level.

Calling the quarterly release a “great report,” another user said they expected a violent move to the upside.

Zscaler stock climbed 4.49% to $205.28 in premarket trading. It has gained about 9% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Deere_resized_a913c16f0a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_b2gold_jpg_2d344842dd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_whitehouse_OG_jpg_2cc16854dc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_39d73f48c3.webp)