Advertisement|Remove ads.

Adobe Stock Sinks Pre-market After Q4 Guidance Disappoints: Retail Stays ‘Extremely Bullish’ On Upbeat Q3

Adobe Inc (ADBE) shares slid over 8% in Friday’s pre-market session after the company’s fourth-quarter guidance fell short of Wall Street’s estimates.

But, let’s take a look at the third-quarter highlights. Adobe managed to beat analyst expectations as its revenue rose 11% year-over-year (YoY) to $5.41 billion versus an estimate of $5.37 billion and adjusted earnings per share (EPS) came in at $4.65, compared to an estimate of $4.53.

However, the software-maker expects fourth-quarter revenue in the range of $5.50 billion to $5.55 billion, below an analyst estimate of $5.60 billion. The firm also guided for an EPS of $4.63 to $4.68 compared to an estimate of $4.66.

Adobe’s Digital Media segment revenue grew 11% YoY to $4.00 billion and registered a 12% growth in constant currency. Document Cloud revenue stood at $807 million, representing an 18% YoY growth. Creative revenue rose 10% YoY to $3.19 billion. The firm said it repurchased approximately 5.2 million shares during the quarter.

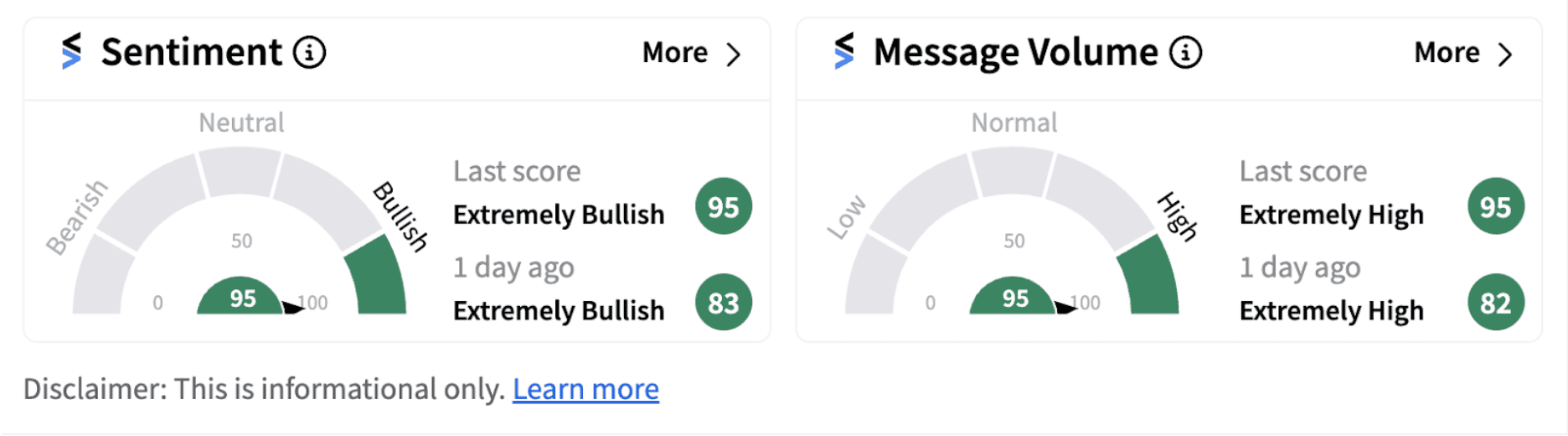

Despite Wall Street’s skepticism on the disappointing Q4 guidance, retail investors on Stocktwits are ‘extremely bullish’ (95/100) on the stock. The move was supported by ‘extremely high’ message volumes (95/100) that hit a one-year high.

Notably, Adobe won some high profile customers during the quarter that include Google, Meta, PepsiCo, the U.S. Navy, Estée Lauder, among others.

Bullish Stocktwits followers of the ticker are optimistic about the customer acquisition, with some believing the stock is set to rally soon.

On Wednesday, the company had announced advancements to its generative AI video capabilities. The firm highlighted that its new Firefly-powered text to video and image to video capabilities will be available on Firefly.Adobe.com, and Generative Extend will be embedded directly into Premiere Pro some time later this year.

Meanwhile, UBS has reportedly lowered its price target on the stock to $550 from $560 while keeping a ‘Neutral’ rating.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_122032465_jpg_9592f3bcfd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Novavax_building_93bfe3bf8c.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)