Advertisement|Remove ads.

Berkshire Hathaway Shares Dip After Insurance Chief Ajit Jain Slashes Stake In Firm By Over 50%: Retail Holds Strong

Shares of Berkshire Hathaway (BRK.A) (BRK.B) fell on Thursday after Ajit Jain, the company’s insurance chief and a key executive under Warren Buffett, sold more than half of his stake.

A regulatory filing revealed that the 73-year-old vice chairman of insurance operations sold 200 Class A shares on Monday at an average price of $695,418 per share, totaling roughly $139 million.

Jain now holds just 61 shares, marking his biggest reduction since joining Berkshire in 1986.

The reasons behind Jain’s decision are unclear, but his timing comes shortly after Berkshire surpassed the $1 trillion market cap at the end of August.

This sale aligns with a broader slowdown in Berkshire’s share repurchase activity, which dropped to $345 million in Q2, down from $2 billion in each of the prior two quarters, according to CNBC.

Berkshire has also been reducing stakes in key holdings this year, including Apple and Bank of America.

Commenting on Jain’s sale, David Kass, a finance professor at the University of Maryland, reportedly noted that it might signal Jain’s view that Berkshire is fully valued at current levels.

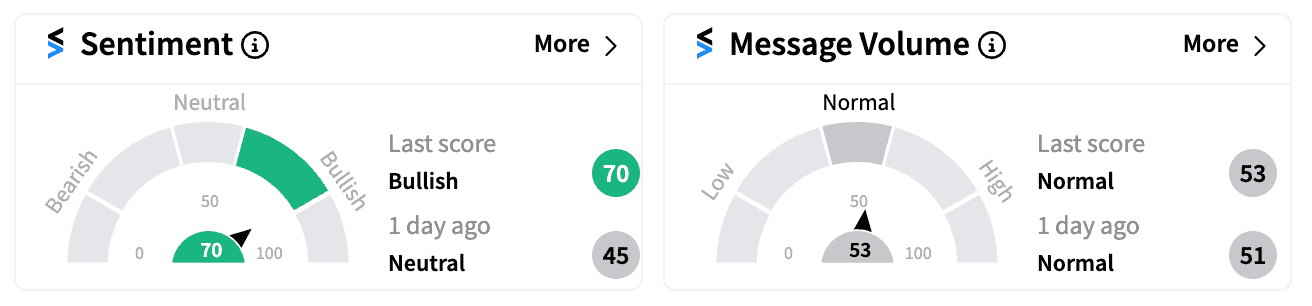

Despite the insider sale, retail sentiment for Berkshire’s Class B shares was ‘bullish’ (68/100) on Stocktwits.

Both BRK.A and BRK.B shares have gained over 20% this year, reflecting overall confidence in the conglomerate.

Keefe Bruyette recently raised its price target on Berkshire Hathaway to $715,000 from $645,000, citing stronger-than-expected Q2 earnings driven by higher underwriting and investment income and a lower tax rate.

Read next: Roku Spikes After Wolf Research Upgrades Stock On Falling Risks, Quickening Growth: Retail Loves It

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_d29fd424cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2021/08/startup_funding1.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/07/logisitics345-2024-07-d688ea87ab99b45532771210d765b8d5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stellantis_ram_truck_OG_jpg_78d19a0ac9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)