Advertisement|Remove ads.

Roku Spikes After Wolf Research Upgrades Stock On Falling Risks, Quickening Growth: Retail Loves It

Shares of Roku Inc. (ROKU) surged over 6% on Thursday after Wolfe Research upgraded the streaming service provider to ‘Outperform’ from ‘Peer Perform’, setting a price target of $93 — an upside of over 25% from current levels.

The upgrade comes amid easing concerns over connected TV (CTV) ad sales and growing confidence in Roku’s focus on monetization and profitability.

Wolfe Research’s analyst highlighted Roku’s streamlined cost structure, evolving sales strategies, and strong position in the CTV market as key reasons for the upgrade.

The brokerage believes Roku’s fundamental risks are diminishing while its growth potential is accelerating, signaling a brighter outlook for the streaming giant.

Roku’s Q2 results, released last month, showed a narrower quarterly loss, boosted by cost-conscious consumers flocking to its platform.

The company reported a 14% increase in streaming households to 83.6 million and a 20% jump in streaming hours to 30.1 billion.

Roku expects revenue to exceed $1 billion in the current quarter, reflecting strong consumer demand.

The firm continues to compete with tech giants like Amazon and Google for viewers, aiming to boost ad and subscription sales across its platform.

With streaming services raising subscription prices and battling over live sports broadcasts, analysts say Roku’s strategic focus on value, ease of use, and choice has kept it running in the competition.

Earlier this month, Wells Fargo upgraded Roku to Equal Weight from Underweight, raising its price target to $72. The firm cited The Roku Channel’s improving monetization as a key driver of future growth.

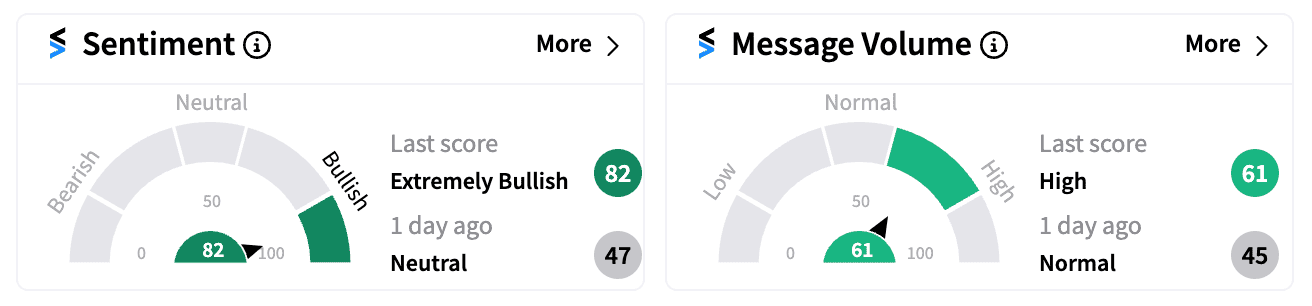

On Stocktwits, retail sentiment for ROKU flipped to ‘extremely bullish’ (87/100) after the latest upgrade, with investors cheering the improved outlook.

Still, Roku shares remain down over 17% this year.

Read next: Micron Gets A Downgrade And Price-Target Cuts, But Retail Investors Stay Bullish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_d29fd424cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2021/08/startup_funding1.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/07/logisitics345-2024-07-d688ea87ab99b45532771210d765b8d5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stellantis_ram_truck_OG_jpg_78d19a0ac9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)