Advertisement. Remove ads.

CAVA Stock’s Retail Following Jumps Most After Upbeat Q2 Results, But Sentiment ‘Bearish’

Shares of fast-casual Mediterranean chain CAVA Inc. (CAVA) saw the highest jump in new retail followers on Stocktwits over the past 24 hours on Thursday, despite ending the session in the red due to profit-booking.

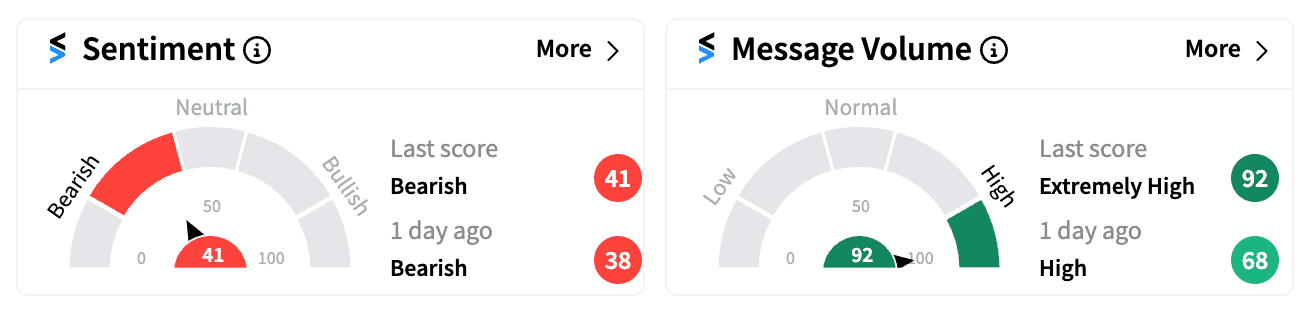

Message volume related to the stock surged more than 575% to reach ‘extremely high’ (92/100) levels, as watchers eagerly discussed the company’s Q2 results, which comfortably beat Wall Street estimates on revenue and profit.

Same-store sales grew by an impressive 14.4%, exceeding most expectations, while traffic increased by 9.5% during the quarter. This suggests that the restaurant chain is reportedly outperforming many of its peers in a challenging economic environment with cost-conscious consumers.

The company highlighted that its grilled steak offering provided customers with "another reason to visit Cava and come back more often." Additionally, CAVA raised its full-year outlook for same-store sales, new location openings, and adjusted profit.

At least four Wall Street brokerages have raised their price targets for CAVA, with Baird setting the highest at $125—representing more than a 12% upside from current levels. However, Barclays is the only brokerage so far with a target below current levels, at $95.

Despite the stock's near-9% jump before the bell on Friday, retail sentiment on Stocktwits remained 'bearish' (41/100), though it showed slight improvement from the previous day.

Several pessimistic observers expressed concerns about the stock’s valuation.

“$CAVA very overvalued imo and fake pump so big boys can unload to bag holders (retail). Caution,” warned one user.

“$CAVA Forward P/E is 300!+. That’s crazy!,” posted another bearish user.

CAVA’s current market cap stands at $11.63 billion, with its valuation having skyrocketed over 167% since its stellar market debut in June 2023.

The stock’s current price-to-earnings (P/E) ratio is 400.86, which significantly exceeds that of Chipotle Mexican Grill (CMG) at 52.38 and Domino’s Pizza Inc. (DPZ) at 25.59.

Wedbush Securities believes CAVA is positioned to sustain positive transaction growth and gain market share over the long term, even relative to its growth peers, adding that the stock's premium valuation would be justifiable.

But on Retail Street, investors are just not able to digest these views for now.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228106047_jpg_9b9a5ca202.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_3187088290_be739dbab0_k_285120121c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_mortgage_new_home_representative_resized_jpg_509b715415.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215331806_jpg_2f8ec8b1b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)