Advertisement|Remove ads.

Battered Celsius Holdings Stock Worries Analysts After Flagging Sales Slowdown Via Pepsi: Retail Turns Bearish

Shares of energy drink maker Celsius Holdings Inc. (CELH) have plunged more than 18% over the past week, triggered by a recent company presentation at the Barclays 17th Annual Global Consumer Staples Conference that raised alarms among investors.

During the presentation earlier this week, Celsius revealed that despite a 10% increase in scanner data and depletions this quarter, sales through its primary distributor, PepsiCo (PEP), are down $100 million to $120 million from last year.

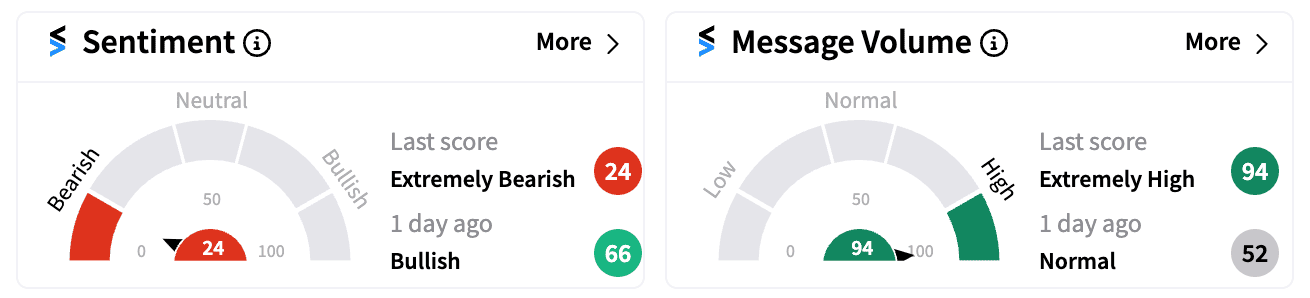

The news sent message volume for CELH on Stocktwits surging by 577% as analysts and retail investors analyzed the implications.

Morgan Stanley reacted by cutting its estimates for Celsius “again”, lowering Q3 and FY24 sales forecasts by 29% and 10%, respectively, while maintaining an ‘Equal Weight’ rating and a $50 price target. The firm said no catalyst is in sight until scanner data trends turn positive.

Piper Sandler also trimmed its price target to $50 from $65, maintaining an ‘Overweight’ rating. The firm anticipates significant operating de-leveraging in Q3 and noted that U.S. energy category momentum has slowed as consumers shift toward bulk purchases in clubs and online channels.

Stifel observed that Celsius' retail sales have outpaced shipments to PepsiCo by about $125 million since their distribution deal began in Q3 2022, and warned that additional inventory reductions could occur if sales trends worsen.

Roth MKM's Sean McGowan cut the price target to $45 from $65, while maintaining a ‘Buy’ rating, saying the inventory reductions by Pepsi would negatively impact Q3 revenues and margins more than anticipated.

Similarly, Jefferies lowered its target to $53 from $68 while keeping a ‘Buy’ rating, warning that this would cause the company’s first sales decline since Q2 2018.

Bank of America analysts pointed to broader demand issues, noting that retail consumption data suggests year-over-year sales could start to decline by the end of Q3, reflecting a potentially more challenging environment for energy drinks amid persistent inflation.

Retail sentiment on Stocktwits turned ‘extremely bearish’ (23/100) on Thursday as message volume remained extremely high.

The stock's RSI currently sits at 24.1, indicating that Celsius stock may be in oversold territory.

CELH has lost over 45% year-to-date, weighed down by concerns over a tight consumer environment and weakening demand for non-essential beverages like energy drinks.

Read next: C3.ai Stock Plummets As Analysts Slash Price Targets Post Earnings: Retail Sentiment Sours

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)