Advertisement. Remove ads.

Salesforce Stock Gets Jim Cramer’s Attention On ‘AI Game Changer’ Factor: Retail Investors Excited Too

Shares of Salesforce Inc. (CRM) surged more than 4% on Thursday after the company delivered strong Q2 results and raised its annual profit outlook, sparking a wave of positive sentiment from analysts and retail investors alike.

The upbeat outlook and promising AI developments prompted several analysts to raise their price targets, while CNBC’s ‘Mad Money’ host Jim Cramer highlighted the stock as one of the top 10 things to watch in the market.

Cramer specifically pointed to Salesforce’s new AI-powered platform, “Agentforce” — designed to help companies automate certain functions — calling it a potential “game changer when it comes to improving gross margins.”

Salesforce CEO Marc Benioff told Cramer that Agentforce would allow companies to “deliver a level of automation with their customer service or with their sales that they’ve never seen before.”

As an example, Cramer explained how Agentforce could help textbook maker Wiley handle the busy back-to-school season by expanding its customer service capabilities without the need for temporary employees.

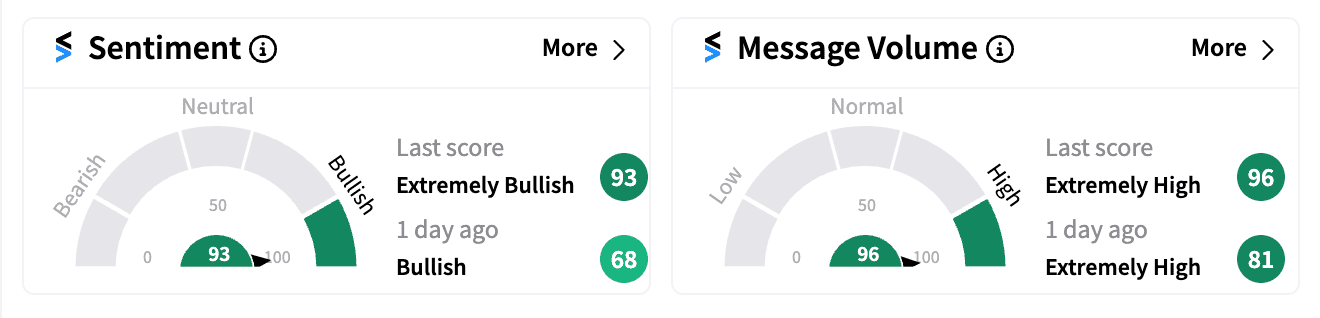

On Stocktwits, sentiment for CRM turned ‘extremely bullish’ (93/100) early on Thursday, marking the second-highest score for the stock this year. Much of the buzz was driven by a slew of positive analyst notes and price target upgrades.

Raymond James raised its price target on CRM to $350 from $325 while maintaining a ‘Strong Buy’ rating, encouraged by multi-cloud deals, burgeoning AI demand, and improvements in average revenue per user (ARPU).

Roth MKM also sees a bright future for Salesforce, maintaining a ‘Buy’ rating and a $335 price target. The firm believes that AI-based technologies like Agentforce could spur a growth rebound for the company over the medium term.

Loop Capital, which raised its price target to $270 from $240 and kept a ‘Hold’ rating, pointed out that a unique aspect of Agentforce (set to be fully unveiled at Salesforce’s upcoming Dreamforce event) is its consumption-based pricing model.

Salesforce shares are up just about 2% this year, as concerns over heavy AI-related capital expenditures and projections of slowing sales growth have weighed on the stock.

But with the recent earnings beat and the excitement surrounding Agentforce, investors appear to have found renewed optimism.

/filters:format(webp)https://news.stocktwits-cdn.com/resized_infosys_logo_generic_jpg_48cdd8cce7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bse_new_resized_jpg_a9ea3d5623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_resized_bse_stock_chart_generic_jpg_7aae96f772.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_xpeng_tesla_jpg_f07bd782e4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rupert_Lachlan_Murdoch_jpg_a407d336ed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/04/fox-news-shutterstock.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)