Advertisement|Remove ads.

Infosys To Mull Buyback: Will Board Nod Push Stock Past ₹1,450 Resistance?

Infosys, India's second-largest IT company, said that its board will meet on September 11 to consider a proposal for the buyback of fully paid-up equity shares.

If approved, this would mark the company's first share buyback since 2022. This comes at a time when US President Donald Trump’s tariff threats on the IT sector and additional visa restrictions weigh on the outlook for Indian IT companies.

Infosys had last approved a proposal for Rs 9,300 crore buyback in 2022, with a minimum buyback price of ₹1,850 per share.

Buyback Boost On Cards

SEBI-registered analyst Nidhi Saxena noted that a company’s decision to consider a buyback comes from three primary factors: returning excess cash to the shareholders, boosting earnings per share by reducing the number of outstanding shares, and signaling management’s confidence through strong cash flow.

A buyback nod usually sparks positive sentiment and can push the stock toward resistance zones in the near term. But she cautioned that the actual impact depends on buyback size, method (tender or open market), and overall IT sector sentiment.

Will Buyback Help Infosys Break Past Crucial Resistance?

On the technical front, Saxena identified immediate support for Infosys at ₹1,430–₹1,421, with deeper support near ₹1,410–₹1,392. On the upside, resistance is seen at ₹1,450–₹1,467 in the short term, while sustained momentum could push the stock toward the ₹1,481–₹1,490 zone.

Investors will be watching out for clarity on quantum, record date & execution of the buyback when the Infosys board meets later this week.

What Is The Retail Mood?

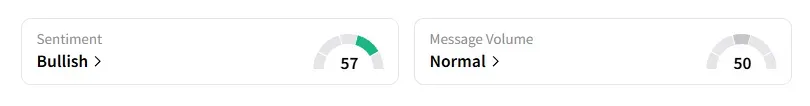

Data on Stocktwits shows that retail sentiment shifted from ‘bearish’ to ‘bullish’ a day ago on this counter.

Infosys shares have declined 24% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)