Advertisement|Remove ads.

Trump Media Stock Faces Pressure As Co-Founder Nearly Exits Stake: Retail Still Bullish

Shares of Trump Media & Technology Group (DJT) slipped 0.6% in pre-market trading on Friday, continuing their downward trend as a major insider drastically reduced his stake.

United Atlantic Ventures, managed by Trump Media co-founder Andrew Litinsky, disclosed in an SEC filing Thursday that it had slashed its holding from over 7.5 million shares to a mere 100 shares.

The sale revelation comes after the expiration of the company’s six-month lockup period, which had restricted insider selling since DJT’s public debut in March.

Until Thursday, United Atlantic had remained one of the top three shareholders of the company.

According to CBS News, if United Atlantic had sold its shares on Sept. 20 — the first day after the lockup expired — the proceeds could have totaled around $102 million. However, if they had been sold when DJT shares hit their record low of $11.75 on Sep. 24, it would have just amounted to $89 million.

Litinsky and Wes Moss, both former contestants on Donald Trump’s reality show “The Apprentice”, co-founded United Atlantic Ventures.

The pair had been involved in launching Trump’s Truth Social platform but later became entangled in lawsuits with Trump Media. In March, a day before DJT stock went public, Trump Media sued Litinsky and Moss, alleging mismanagement and seeking to strip them of their shares.

Despite these insider exits, Trump, the largest shareholder in DJT with nearly 60% of the company’s outstanding stock, reiterated his intent to hold onto his stake.

Trump’s refusal to sell has likely provided some stability for retail investors, who continue to show cautious optimism.

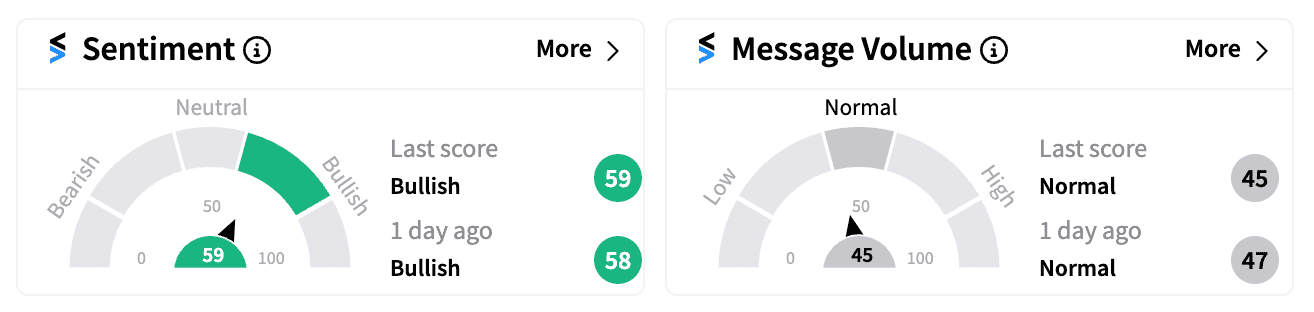

On Stocktwits, sentiment for DJT remained ‘bullish’ in pre-market trading on Friday, suggesting that many retail traders are holding out hope, betting on Trump’s influence and potential political success as a catalyst for the stock’s recovery.

However, fundamental concerns linger. The company posted weak Q2 results, with a net loss of $16.4 million and a 30% drop in revenue, which fell to just $837,000.

Despite having $344 million in cash and no debt, the financial outlook has contributed to the stock’s sharp decline — down more than 75% from its debut following the SPAC merger in March.

Read next: Jabil Stock Soars On Earnings Beat, $1B Buyback Plan: Retail Enthusiasm Surges

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)