Advertisement|Remove ads.

Jabil Stock Soars On Earnings Beat, $1B Buyback Plan: Retail Enthusiasm Surges

Shares of manufacturing specialist Jabil, Inc. (JBL) surged over 11% on Thursday, with trading volume hitting 1.86 million — 1.4x the daily average.

The spike followed the company’s better-than-expected fourth-quarter earnings and restructuring announcements, which fueled optimism among retail investors.

Jabil reported revenue of $6.96 billion for the quarter, down from $8.46 billion a year ago due to the sale of its Mobility business.

However, the figure surpassed analyst expectations of $6.59 billion.

Adjusted fourth-quarter earnings came in at $2.30 per share, comfortably beating the consensus estimate of $2.22.

Looking ahead, Jabil forecasts first-quarter earnings between $1.65 and $2.05 per share, compared to analysts’ estimate of $1.83.

The company also approved a $1 billion stock buyback program and disclosed plans for up to $200 million in restructuring costs aimed at reducing headcount in its manufacturing units.

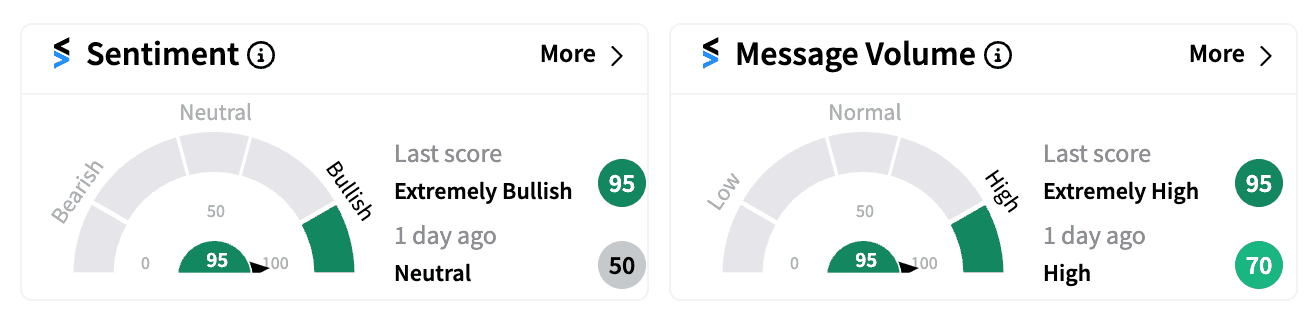

On Stocktwits, sentiment for JBL soared into ‘extremely bullish’ (95/100) territory — its second-highest level this year — reflecting strong retail optimism.

Jabil, based in St. Petersburg, Florida, manufactures electronic components and systems for industries such as automotive, cloud computing, commercial drones, and buses. Apple is one of its key clients.

CEO Mike Dastoor highlighted confidence in the company’s mid-to-long-term positioning in markets such as data center power and cooling, electric and hybrid vehicles, semiconductor equipment, and healthcare.

He acknowledged short-term challenges in certain end markets but emphasized Jabil’s potential to capitalize on secular trends.

With Thursday’s gains, JBL has nearly erased its year-to-date losses.

Read next: Starbucks Stock Brews Gains After Bernstein Upgrade On New CEO Factor: Retail Stays Optimistic

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2251311021_jpg_31a407e714.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aluminum_resized_jpg_6efa759339.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_f7a640a687.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1257075116_jpg_22f4f6802d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)