Advertisement|Remove ads.

Trump Media & Tech Stock Plummets, Retail Gets ‘Extremely Bearish’ After Key Execs Dump Shares

Shares of Trump Media & Technology Group (DJT), the parent company of Truth Social, fell nearly 7% on Wednesday, after a series of high-profile stock sales by key executives, prompting bearish sentiment among retail investors.

According to recent SEC filings, the company’s CFO, Phillip Juhan, sold $1.92 million worth of shares, while CEO Devin Nunes offloaded shares worth $63,210.

Other executives who sold shares include COO Andrew Northwall ($78,700), CTO Vladimir Novachki ($177,082) and General Counsel and Secretary Scott Glabe ($92,684).

The filings clarify that these sales were conducted to cover withholding payments to taxing authorities, with no cash proceeds received by the executives.

However, the optics of top executives selling shares have rattled investors.

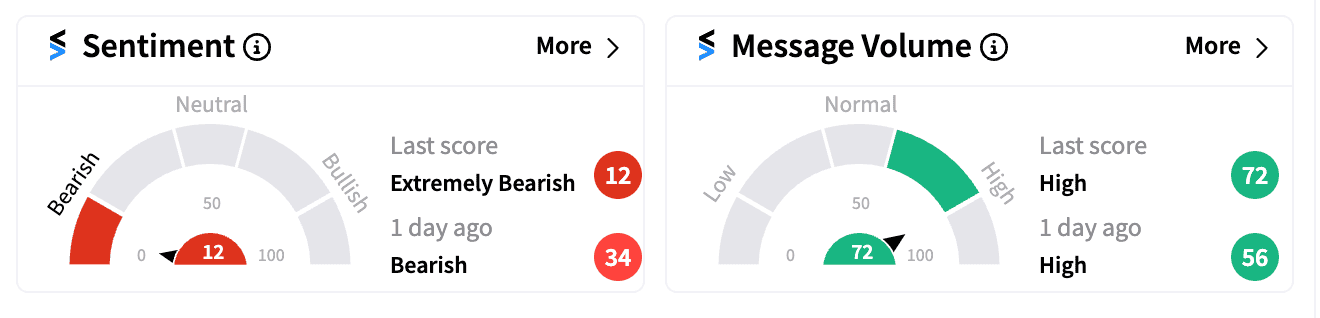

On Stocktwits, sentiment for DJT has turned ‘extremely bearish’ (13/100) amid high levels of chatter.

One bearish user (with apparent sarcasm) posted, “$DJT strong support at $0,” while another claimed to have profited $82,000 by shorting the stock.

Additionally, a lock-up period barring former President Donald Trump from selling his shares in the company is nearing its end.

According to Quartz, Trump’s stake in DJT is under a six-month lockup period that could end as soon as Sept. 20 — if the stock remains above $12 for any 20 trading days starting Aug. 22. If shares fall below $12, the earliest Trump could sell would be Sept. 25, regardless of the stock’s value.

John Rekenthaler, Vice President of Research at Morningstar, reportedly believes DJT is “extremely overvalued” and sees it as a great cash-out opportunity for Trump, who in theory has “well over $2 billion to realize.”

DJT’s slide has also been exacerbated by a $16.4 million net loss in Q2 and a 30% drop in revenue.

Shares of the company, which have been extremely volatile due to news events involving Trump, have lost more than 65% of their value since going public via a SPAC merger in March.

Trump is set to debate Vice President Kamala Harris live on Sept. 10 in Philadelphia. With DJT stock near record lows and a potential Trump stock sale on the horizon, analysts like Rekenthaler warn that a political defeat could push the stock “to zero.”

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)