Advertisement|Remove ads.

Las Vegas Sands, Wynn Resorts Stocks Jump After China Stimulus, But Retail Investors Favor Only One

Shares of casino operators Las Vegas Sands Corp. (LVS) and Wynn Resorts Ltd. (WYNN) surged more than 4% on Friday, driven by optimism surrounding China’s latest economic stimulus measures.

Both companies, which generate a significant portion of their revenue from their casinos in Macau, are riding a post-pandemic rebound in travel to China’s gaming hub.

Las Vegas Sands owns five casinos in Macau, which contributed $1.75 billion of the company’s $2.76 billion second-quarter revenue.

Wynn Resorts has also reported that its Macau properties, Wynn Palace and Wynn Macau, accounted for the largest share of its revenue in the past two quarters.

The People's Bank of China's stimulus package, the largest since the pandemic, aims to pull the economy out of deflation and back on track with growth targets, sparking enthusiasm for companies with substantial exposure to the Chinese market, like LVS and WYNN.

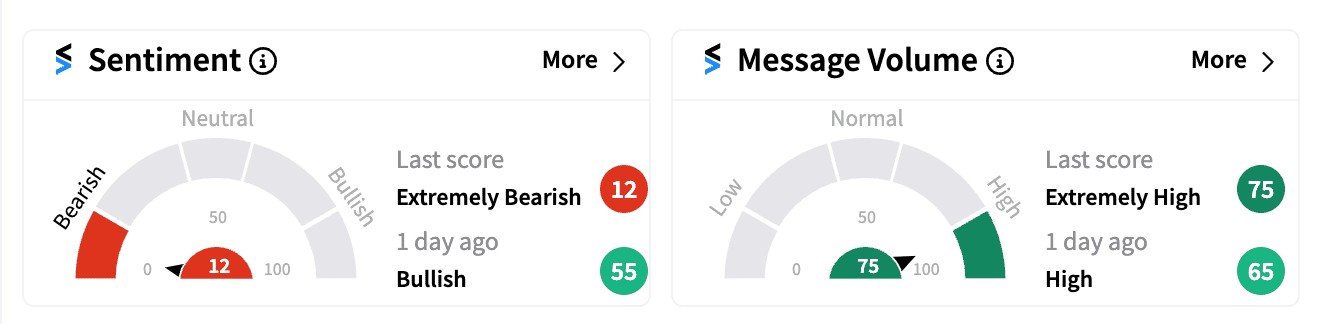

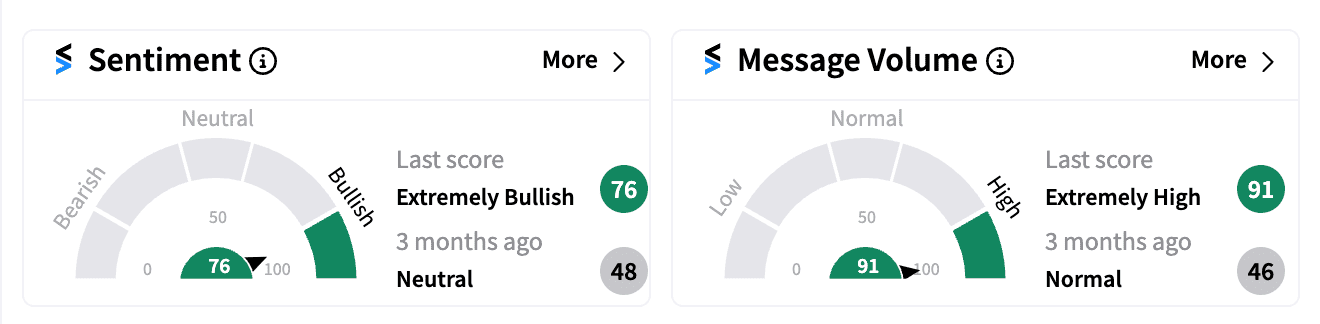

However, retail sentiment tells a different story for both stocks. On Stocktwits, retail investors were 'extremely bullish' on Wynn but 'extremely bearish' on Las Vegas Sands, a divergence that mirrors recent analyst reports.

Morgan Stanley upgraded Wynn Resorts on Thursday, raising its rating to 'Overweight' with a price target of $104, up from $97. Analyst Stephen Grambling highlighted Wynn's "near low" valuation, growth opportunities in the United Arab Emirates, and the potential for a re-rating around its Macau operations as factors driving the stock's 25% upside.

Morgan Stanley expects increased capital returns and details on Wynn's UAE project, which are likely to act as near-term catalysts.

On the flip side, Morgan Stanley last week lowered its price target on Las Vegas Sands to $50 from $55, citing weaker trends in Las Vegas and plateauing growth in Macau. While LVS maintains an 'Overweight' rating, the firm flagged challenges in the broader gaming sector.

Still, Sands China, a subsidiary of Las Vegas Sands, received an upgrade with a higher price target, driven by identifiable catalysts like dividend boosts and market share gains, offering some downside protection.

Moreover, both companies face challenges in their home market. Nevada reported a 3.8% decline in statewide gaming revenue for August, continuing a downtrend seen in July, where revenue fell 6.9%.

Year-to-date, Wynn stock is up 1.3%, outperforming Las Vegas Sands, which has slipped 1.2%.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215666275_jpg_07d03239b9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)