Advertisement|Remove ads.

Cassava Sciences Stock Slides After $40M SEC Settlement Over Misleading Alzheimer’s Trial Claims, Captures Retail Spotlight

Shares of Cassava Sciences, Inc. (SAVA) fell more than 12% in pre-market trading on Friday, following the company’s announcement of a $40 million settlement with the U.S. Securities and Exchange Commission (SEC).

The penalty, related to misleading claims made about its Alzheimer’s drug trials, drew significant attention from retail investors, making SAVA the top trending ticker on Stocktwits by 9 a.m. ET.

The SEC charged Cassava and two former executives — founder and former CEO Remi Barbier and former Senior VP of Neuroscience Lindsay Burns — with making misleading statements in 2020 regarding the results of a clinical trial for their experimental Alzheimer's treatment, simufilam.

The regulator alleged that the company claimed the drug "significantly improved patient cognition," while failing to disclose that full patient data showed "no measurable cognitive improvement" in episodic memory.

Hoau-Yan Wang, a professor at the City University of New York Medical School who worked with Cassava to develop the drug, was also charged with manipulating trial data.

Cassava agreed to the settlement without admitting or denying the charges.

"Cassava is pleased to put this matter behind us," CEO Richard Barry said in a statement. "We can now focus all of our attention on completion of the ongoing Phase 3 trials of simufilam.”

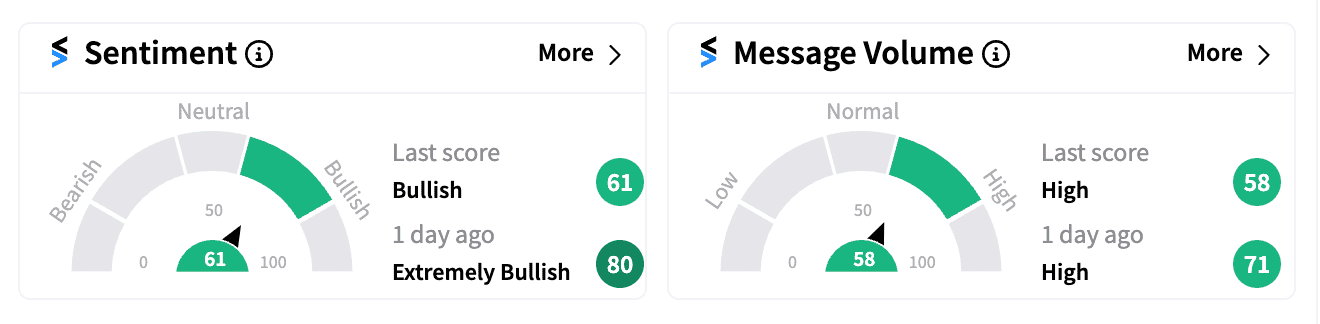

Despite the stock’s sharp decline early on Friday, retail sentiment for SAVA remained ‘bullish’.

Many investors on Stocktwits saw the settlement as a non-event, with some noting that the $40 million had already been set aside for the penalty.

One user remarked, “We knew it was coming… This doesn’t take anyone by surprise.”

Others were even more optimistic, focusing on the company’s Phase 3 trials, adding that with the SEC issue resolved, the path is clear for Cassava to move ahead with its clinical trials and potential FDA approval.

Earlier this week, Cassava announced that a Data and Safety Monitoring Board completed a third interim safety review of simufilam, recommending that the ongoing Phase 3 studies continue without modifications.

Chief Medical Officer Jim Kupiec stated that the company is on track to announce top-line data for the 12-month Phase 3 study by the end of 2024.

Despite recent setbacks, SAVA stock is still up more than 40% year-to-date. Retail investors appear to be holding out hope for a potential breakthrough as the company moves closer to critical trial results later this year.

Read next: Trump Media Stock Faces Pressure As Co-Founder Nearly Exits Stake: Retail Still Bullish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JP_Morgan_JPM_resized_jpg_5def7e91d0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)