Advertisement|Remove ads.

Meta Pleases Wall Street With AI Product Roadmap: Retail Stays Happy As Stock Stays Red-Hot

Shares of Meta Platforms, Inc. (META) rose over 1% early on Thursday, building on Wednesday's gains after the company unveiled a series of new AI and hardware products at its annual Connect conference.

CEO Mark Zuckerberg kicked off the event by introducing several key updates, including a lower-cost version of the Quest 3S headset priced at $299.99—significantly undercutting Apple's $3,500 Vision Pro. Meta also revealed its prototype Orion AR glasses, which it claims are the "most advanced pair of AR glasses ever made."

In partnership with Ray-Ban, Meta also announced new features for its smart glasses, including live translation, Spotify integration, and the ability to remember information like phone numbers or parking spots.

Following the announcements, Wall Street analysts responded positively.

JPMorgan raised its price target on Meta to $640 from $610, maintaining an 'Overweight' rating. The firm believes Meta's strong operating results and AI product roadmap justify continued heavy investment in AI.

Citi also reiterated a 'Buy' rating and raised its price target to $645, stating that Meta's AI-driven product innovation will boost engagement and monetization. The firm views the Ray-Ban Smart Glasses as a "must buy" that can lead to greater overall engagement across Meta.

Jefferies praised Meta's LLaMA large language model, noting its growing presence in enterprise AI, and calling Meta "one of our top AI picks."

Wedbush Securities expressed optimism about Meta AI, predicting it could become the most-used AI assistant globally by year-end. Despite heavy ongoing losses in Meta's Reality Labs division, Wedbush believes its investments in AI are becoming more synergistic with Meta's core business.

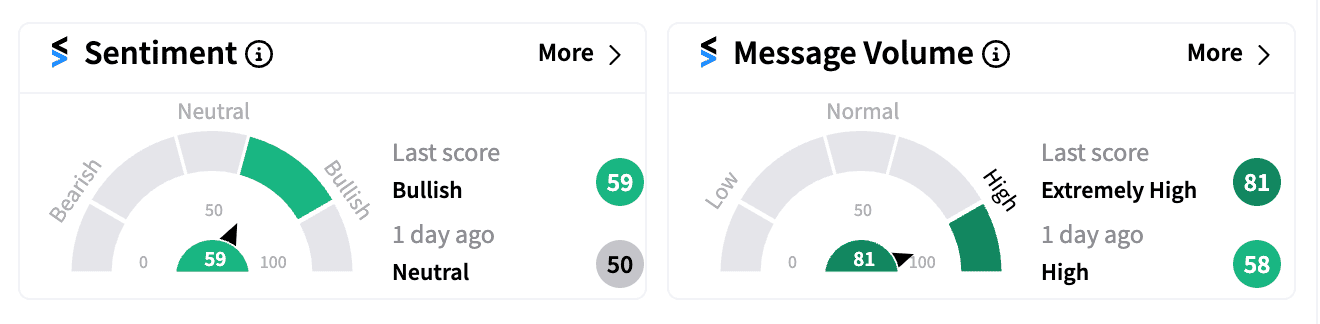

On Stocktwits, retail sentiment for Meta turned ‘bullish’ (59/100) before the opening bell on Thursday. Meta was one of the top 10 trending tickers, with message volume surging following the Connect conference.

With several analysts raising price targets, Meta remains the second best-performing stock in the tech-heavy 'Magnificent 7' group this year, boasting a YTD gain of over 64%.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1959831267_jpg_c83b1e0d88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/moderna_hq_resized_jpg_97563ed423.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)