Advertisement|Remove ads.

Micron Stock Supercharges On Earnings Beat And Rosy Outlook: Analysts Raise Price Targets On AI Boost

Shares of Micron Technology Inc. (MU) surged over 15% pre-market on Thursday, reportedly on track for their biggest intraday gain in six months.

The jump follows strong Q4 earnings and optimistic forecasts driven by robust demand for AI-related products.

Micron reported Q4 revenue of $7.75 billion, up 93% year-over-year and above Wall Street's consensus of $7.63 billion. The company posted earnings per share (EPS) of $1.18, also beating analysts' expectations of $1.13.

CEO Sanjay Mehrotra said, "Robust AI demand drove a strong ramp of our data center DRAM products and our industry-leading high bandwidth memory. Our NAND revenue record was led by data center SSD sales, which exceeded $1 billion in quarterly revenue for the first time."

Micron is projecting revenue of $8.5-$8.9 billion for Q1 2025, beating consensus estimates of $8.33 billion. The company guided for EPS of $1.66-$1.82, surpassing an estimate of $1.67.

Wall Street analysts reacted positively to the results, with many raising their price targets.

Citi reiterated its ‘Buy’ rating on Micron, setting a $150 target, citing a strong data center market offsetting excess DRAM inventory in PCs and handsets.

BofA raised its price target from $110 to $125, projecting EPS increases of 22% and 31% for FY25 and FY26, respectively.

Morgan Stanley also raised its price target on Micron to $114 from $100 but maintained an 'Equal Weight' rating. While the firm acknowledges Micron's strong execution, it feels the company’s high-bandwidth memory (HBM) market forecast is “too high”.

The brokerage also believes the stock remains expensive and sees better risk-reward opportunities elsewhere in the AI and memory sectors.

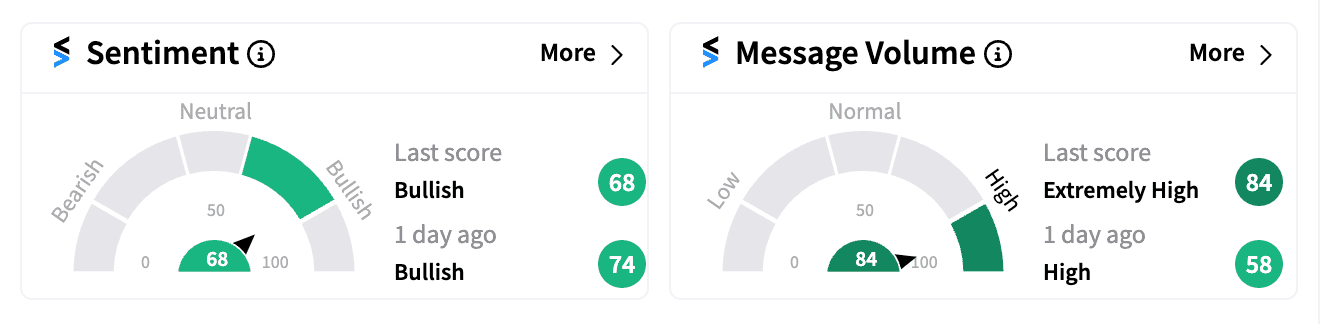

Retail investors on Stocktwits remained optimistic, with sentiment sitting at ‘bullish’ (64/100) levels and message volume spiking after the earnings report.

Micron’s HBM is used in Nvidia processors to speed up AI model data processing. The company reported on Wednesday that its AI-related products for 2024 and 2025 have been sold out.

Micron stock is now up over 16% year-to-date, riding the wave of increased AI investment and long-term supply contracts.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)