Advertisement|Remove ads.

Nvidia Stock Rated ‘Outperform’ By William Blair: Retail On The Fence For Now

Nvidia Corp. (NVDA) saw some pre-market gains on Wednesday, following a lower close the previous session.

The stock is down nearly 18% from its June peak, reflecting a broader chip sector downturn, weighed down by regulatory trade curbs due to geopolitical tensions, and skepticism over the sustainability of the AI boom.

Despite these headwinds, William Blair analyst Sebastien Naji initiated coverage of Nvidia with an ‘Outperform’ rating, emphasizing the company’s dominance in parallel computing.

Naji highlighted Nvidia’s history in specialized markets like gaming, automotive, and high-performance computing (HPC), stating that the rising demand for AI has placed Nvidia’s parallel computing systems at the forefront of the tech industry.

Nvidia’s data center revenue grew by 217% in fiscal 2024 and is projected to surge another 132% in fiscal 2025, possibly exceeding $110 billion in annual revenue, according to Naji.

However, this optimism wasn’t fully reflected among retail investors.

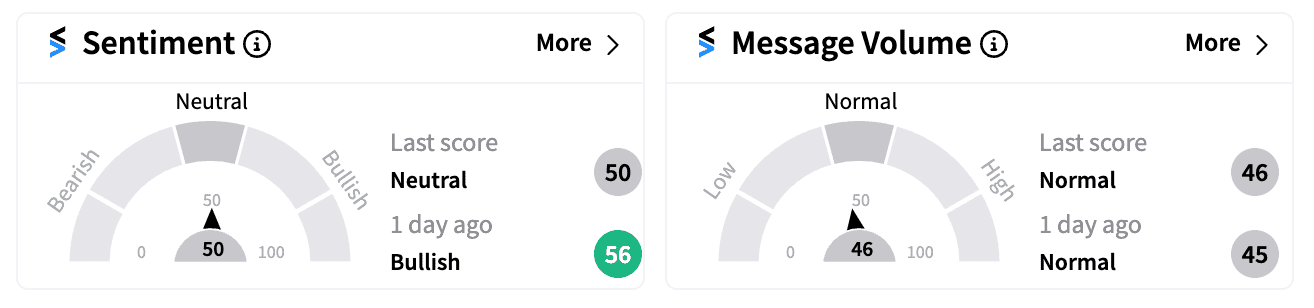

Sentiment among Nvidia’s 530,000 followers on Stocktwits slipped from ‘bullish’ to ‘neutral’ as of Wednesday morning.

Some bulls remain hopeful, with chatter focusing on a potential Federal Reserve rate cut to uplift the stock.

But skeptics, wary of volatility, advised caution in the short term.

Nvidia, now valued at over $3 trillion, remains the third most valuable publicly traded company.

CEO Jensen Huang’s recent comments on soaring demand for the company’s AI chips, alongside reports of eased U.S. trade restrictions and the announcement of a $50 billion stock buyback, have buoyed investor confidence.

Nvidia on Tuesday also announced a new partnership with Salesforce to integrate AI tools into the CRM giant’s platform, aiming to boost productivity and deliver new insights.

Despite the recent pullback, NVDA is still up nearly 140% year-to-date, significantly outperforming the S&P 500 and Nasdaq.

Read next: Intuitive Machines Stock Skyrockets 52% After $4.82B NASA Contract Win: Retail Is Exuberant

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)