Advertisement|Remove ads.

Rivian Regains Investor Love, Tesla Faces Backlash Despite Stock Rebound: What’s Driving The Divide?

The electric vehicle (EV) market is witnessing a stark contrast in retail investor sentiment on Monday, with Rivian Automotive (RIVN) gaining traction and Tesla (TSLA) failing to spark any enthusiasm despite its recent share price rebound.

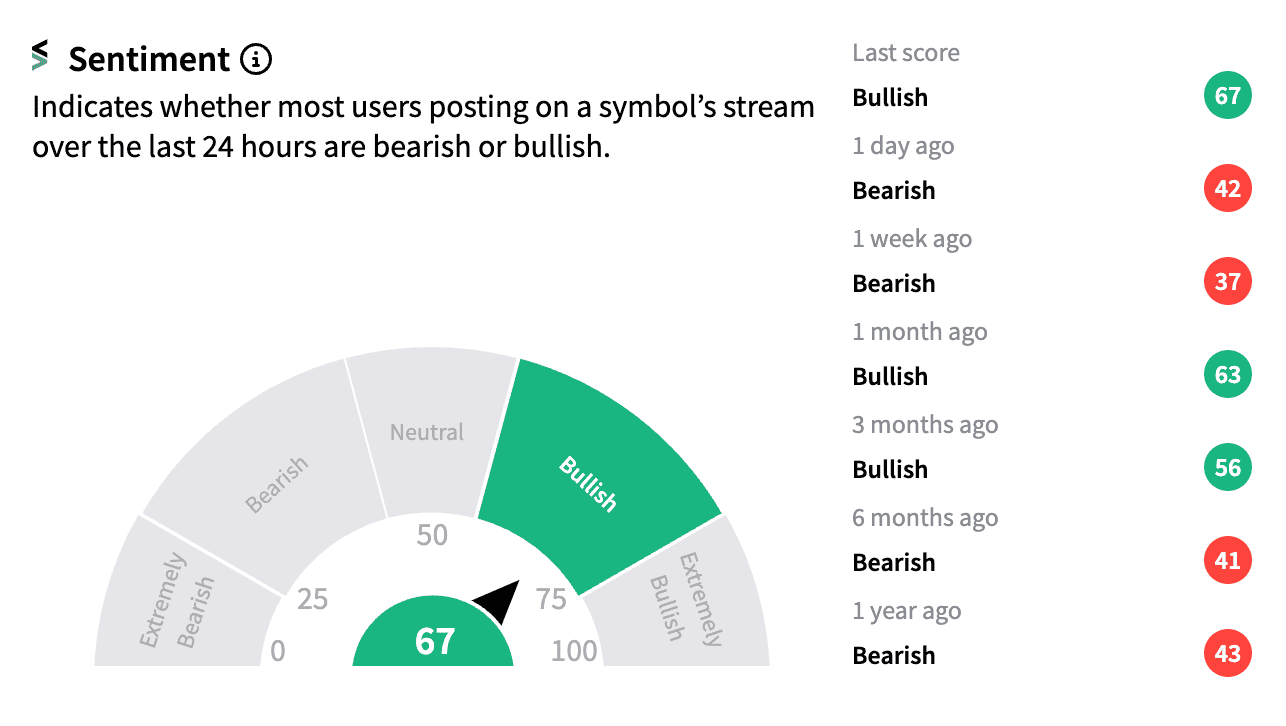

Rivian’s share price is flat today, but its Stocktwits sentiment score has climbed back into bullish levels after a week, and has hit its highest point (67/100) in a month.

This uptick was mainly driven by reports of Germany's antitrust body giving the green light for Rivian's joint venture with Volkswagen (VWAGY), involving a potential $5 billion investment. Wall Street and main street both believe this partnership will propel Rivian forward, as evidenced by the stock's 16.50% gain over the past month.

The company earlier reported second-quarter production and delivery figures in line with estimates. Additionally, it revealed that it surpassed the 100,000 pre-order mark for its upcoming R2 model, a sub-$50,000 electric vehicle expected to boost sales volumes.

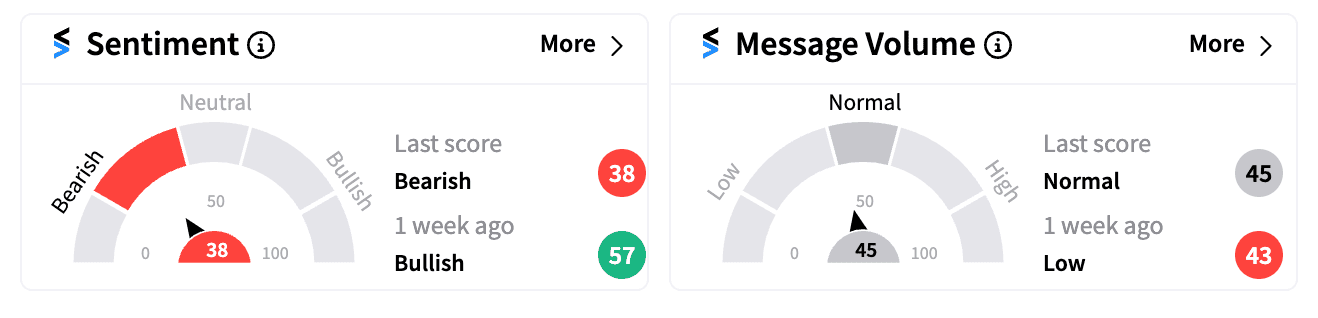

On the other hand, Tesla's stock has encountered a colder reception from retail investors even with shares up nearly 6% today. The company's sentiment score on Stocktwits has dipped back into bearish territory at 38/100.

Even though Tesla on Monday was named Morgan Stanley’s top pick in U.S. autos and Piper Sandler recommended a “buy” on the stock based on a "revolutionary" full self-driving (FSD) update, retail investors remained unconvinced.

Tesla's stock has declined by nearly 8% over the past five days due to a disappointing Q2 earnings report that revealed its lowest profit margins in half a decade. The intense EV price war and declining consumer demand have further exacerbated Tesla's challenges.

Still, Piper Sandler’s bullish analysts think investors should consider the possibility that the company’s robo-taxi event scheduled for October 10 "isn't a ploy to distract from falling EV sales" even as they admitted investors "have grown accustomed to ignoring Tesla's hyperbole" around FSD.

While Rivian is capitalizing on strategic partnerships and production milestones, Tesla is grappling with intense competition and margin pressures. For now, retail investors are tilting more in favor of the EV maker with more “concrete” updates.

Photo courtesy: Rivian

/filters:format(webp)https://news.stocktwits-cdn.com/large_target_logo_resized_jpg_3025bd9bb0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nike_store_china_jpg_de6b425c19.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929487_jpg_1b0e45ffb3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_eed3c7d98b.jpg)