Advertisement|Remove ads.

Trump Media Stock (DJT) Dominates Retail Chatter As Sentiment Tanks On Stocktwits After Biden Exits 2024 Race

Shares of Trump Media & Technology Group (DJT) reversed premarket gains on Monday, falling nearly 1.7% to $34.40 by 10:45 am ET, with retail sentiment reflecting the decline.

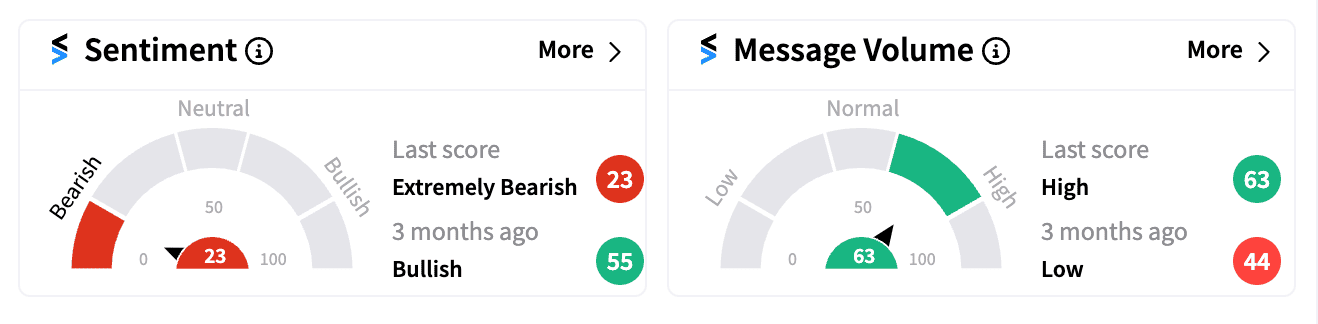

According to Stocktwits, the retail sentiment score for DJT plummeted to extremely bearish levels seen exactly a week ago (23/100), despite it being the most discussed symbol over the past 24 hours.

What’s fueling all the chatter? President Joe Biden announced on Sunday that he will not seek reelection and endorsed Vice President Kamala Harris as the Democratic nominee, leaving investors reassessing the odds of a second term for Republican nominee Donald Trump in the November election.

Although this news briefly buoyed DJT before the opening bell, the gains quickly evaporated amid uncertainties about the final Democratic nominee and the stock’s fundamentals.

Last week, DJT tumbled as much as 11% following a share offering related to the resale of 37.97 million shares of Trump Media & Technology Group common stock, erasing gains made after an attempted assassination on Trump.

Additionally, the U.S. Securities and Exchange Commission filed a lawsuit against the former CEO of the blank-check company that merged with Trump Media, accusing him of misleading investors about the merger plans with Donald Trump’s social media startup.

Trump Media and Digital World completed their protracted public merger in March, but the stock has since shed over 40% of its value. A post-SPAC audit earlier this year revealed a $58 million loss for the company in 2023. Trump holds a 64.90% stake in TMTG, amounting to 114.70 million shares.

The stock, which currently has an 11.04% short interest on its free float, has been trading below its 50-day moving average of $40.66 since mid-June. Discussions on DJT’s Stocktwits stream revealed a highly polarized audience, with debates frequently splitting along partisan lines as users compared the presidencies of Biden and Trump.

Retail watchers are now left to ponder whether DJT can rebound amid this political and financial turbulence, as the market remains divided over the future prospects of Trump Media & Technology Group.

Photo courtesy: Gage Skidmore on Flickr

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)