Advertisement|Remove ads.

Tesla’s Robotaxi Day Could Spark A ‘Sell-The-News’ Event, Barclays Warns: Stock Falls Pre-Market, Retail Turns Bearish

Tesla, Inc. (TSLA) shares dipped 0.4% pre-market Monday, and retail sentiment followed suit, trending negative.

Barclays issued a note ahead of Tesla’s highly anticipated Robotaxi Day on Oct. 10, calling it a “radical pivot” in the company’s investment narrative that has been developing over the last six months.

According to the brokerage, the event will be crucial in detailing Tesla’s future growth strategy, shifting focus from electric vehicles (EVs) to autonomy and artificial intelligence (AI).

Tesla plans to unveil its robotaxi at Warner Bros. Discovery Inc.’s studio in Los Angeles, according to Bloomberg.

CEO Elon Musk has increasingly emphasized autonomy, with plans for a ride-hailing app that combines Tesla’s robotaxis and consumer-owned cars, eliminating the need for human drivers.

Barclays believes that while Tesla’s Robotaxi Day will generate significant attention, it could lead to a “sell the news” scenario.

The brokerage predicts a driverless pilot in select locations but remains cautious about the challenges of scaling Tesla’s autonomous fleet.

Analysts at the firm expect a new model, which they call the “Model 2.5”, to be revealed during the event. Barclays maintained its ‘Equal Weight’ rating on Tesla, with a $220 price target.

Meanwhile, Tesla is set to report third-quarter deliveries this week, with Wall Street estimates rising in anticipation. Analysts expect deliveries to be around 462,000, while some forecast the figure to be as high as 470,000. The optimism is largely driven by strong weekly insurance data in China.

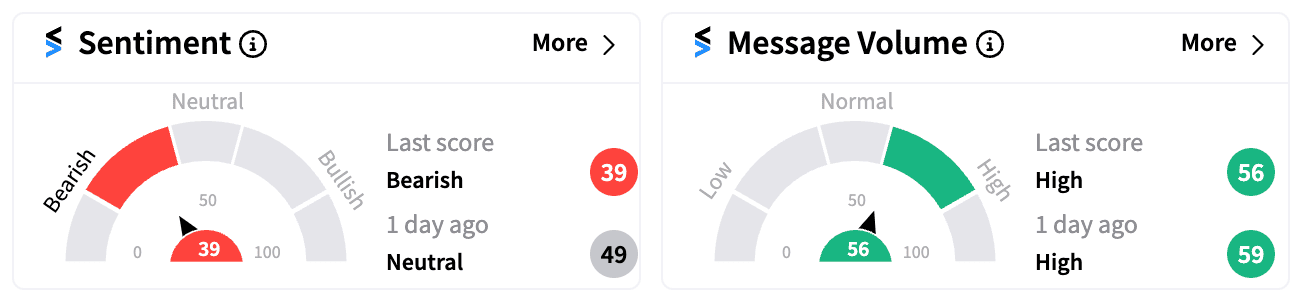

Despite the buzz, on Stocktwits — where TSLA has the largest following — retail sentiment was ‘bearish’.

Many investors expressed concern over the robotaxi launch, viewing it as potentially underwhelming.

Broader concerns about the EV market, including profit warnings from European automakers like Stellantis and Aston Martin, added to the caution.

Though Tesla stock has faced challenges throughout the year, weighed down by earnings misses, narrowing margins and a slowdown in the EV market, it has rebounded and is now up nearly 5% year-to-date.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2156649816_jpg_bde9d5ac58.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230529087_jpg_ce4582941c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Meta_jpg_0f17dacb20.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244842667_jpg_931c352b95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)