Advertisement|Remove ads.

Tesla Stock Jumps As Barclays Predicts Q3 Deliveries Beat: Retail Sentiment Charges Up

Shares of Tesla Inc. (TSLA) surged over 4% on Monday morning after Barclays projected that Tesla’s Q3 deliveries would surpass expectations.

The firm expects the electric vehicle (EV) giant to report 470,000 units during the quarter, an 8% increase year-over-year, outpacing the consensus estimate of 461,000.

Barclays noted that a delivery beat could strengthen Tesla’s stock further and ease concerns about the company’s fundamentals.

The firm highlighted China as the primary driver of Q3 volume strength, while sales in Europe remain weak. Barclays maintained an “Equal Weight” rating on Tesla, with a price target of $220.

Wolfe Research and Goldman Sachs provided similar forecasts, expecting around 460,000 deliveries, in line with the consensus.

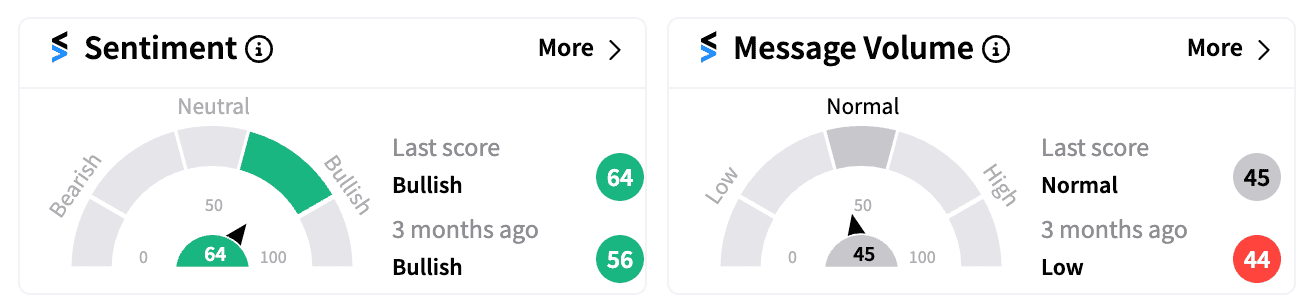

Tesla was one of the top five most active stocks on Stocktwits Monday morning. Retail sentiment grew even more ‘bullish’ as message volume saw an uptick.

One retail investor projected a steady rise for Tesla, with targets of $300 by the end of 2024 and $450 by 2026.

Meanwhile, buzz around CEO Elon Musk’s latest post on X (formerly Twitter) also sparked some excitement. Musk hinted that Tesla’s full self-driving (FSD) capability could eliminate the need for buses.

Despite Monday’s gains, Tesla remains the worst performer among the “Magnificent 7” stocks this year, but Monday’s jump has brought it back into positive territory.

With delivery numbers on the horizon and positive retail sentiment building, Tesla shares could see further strength heading into its Q3 earnings report.

Read next: Meta Looks To Extend Hot Streak — And Retail Isn’t Worried About The Dizzying Levels

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2156649816_jpg_bde9d5ac58.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230529087_jpg_ce4582941c.webp)