Advertisement|Remove ads.

Visa Stock Slips On DOJ Antitrust Worries: Retail On Sidelines As 2 Analysts Downplay Long-Term Risks

Shares of Visa Inc. (V) fell over 2% on Monday, marking its second consecutive day in the red after the Department of Justice (DOJ) filed an antitrust lawsuit against the payments giant.

The DOJ accuses Visa of monopolizing debit transactions, stifling competition, and leveraging its dominance to suppress emerging technologies and alternative debit networks.

The suit, filed in the U.S. Southern District Court of New York, claims Visa’s practices, including restrictive contracts and pricing structures, prevent competitors from entering the market.

The DOJ said it seeks court intervention to stop Visa from engaging in these practices and to address the alleged anticompetitive behavior.

JPMorgan analyst Tien-tsin Huang maintained an ‘Overweight’ rating on Visa, noting that many of the DOJ’s claims focus on common industry practices like volume-based discounting.

While the legal battle could drag on for years, Huang believes the lawsuit might pressure Visa’s pricing power in the near term.

JPMorgan retained Mastercard (MA) as its top pick in the payments sector but sees potential gains for competitors like Fiserv (FI) and FIS (FIS), which own rival PIN networks.

Despite the lawsuit, two major Wall Street analysts downplayed the immediate financial risks.

Morgan Stanley called the stock’s recent weakness a “compelling buying opportunity.” The brokerage expects the legal process to take years, and maintains its ‘Overweight’ rating with a $322 price target on Visa shares.

Keefe Bruyette reiterated an ‘Outperform’ rating with a $325 price target, noting that while the lawsuit could weigh on the stock, it does not see the case as a “slam dunk” for the DOJ.

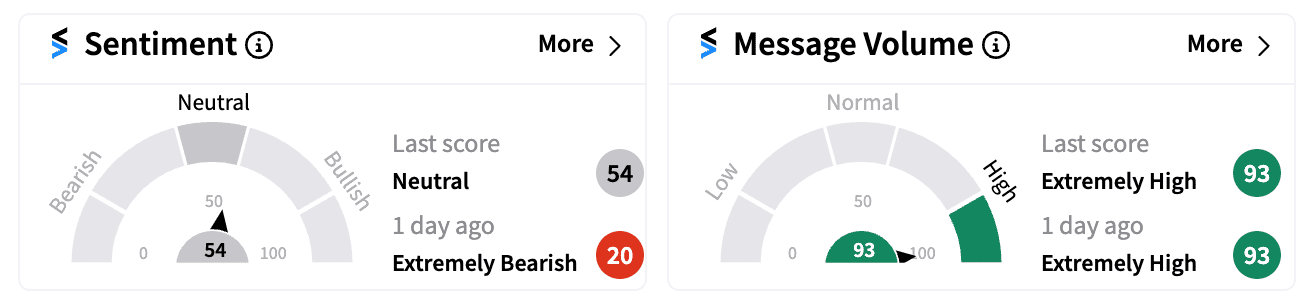

On Stocktwits, retail sentiment for Visa remained ‘neutral’, with users split on the potential fallout.

One bearish user predicted a significant drop for Visa, while a bullish watcher dismissed the lawsuit as “laughable” and said they were buying the dip.

Visa stock has gained nearly 4% year-to-date, trailing behind Mastercard’s 15% rise. Meanwhile, Fiserv and FIS have surged 32% and 35%, respectively, potentially positioning them to benefit from increased competition in the debit market should the DOJ succeed in its case.

Read next: Celsius Holdings Stock Falls After Another Analyst’s Revenue Cut, Retail Sentiment Sours

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_hassett_jpg_1eb8c227c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229940320_jpg_5bc20a70df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2216479170_jpg_edce233c83.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_parazero_technologies_drone_representative_resized_f67140d5c3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)