Advertisement|Remove ads.

Warren Buffett’s Berkshire Hathaway Continues Offloading Bank Of America Shares: Here’s How Retail Reacted

Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) has shed more of its stake in Bank of America (BAC), according to a latest SEC filing. Berkshire sold over 24.66 million shares of the lender at prices ranging between $39.7504 and $39.8692 apiece, raising over $981 million.

The sale was conducted between Aug. 23 and Aug. 27, the filing shows. Berkshire started offloading its stake in Bank of America in mid-July and has so far reportedly raised approximately $5.4 billion.

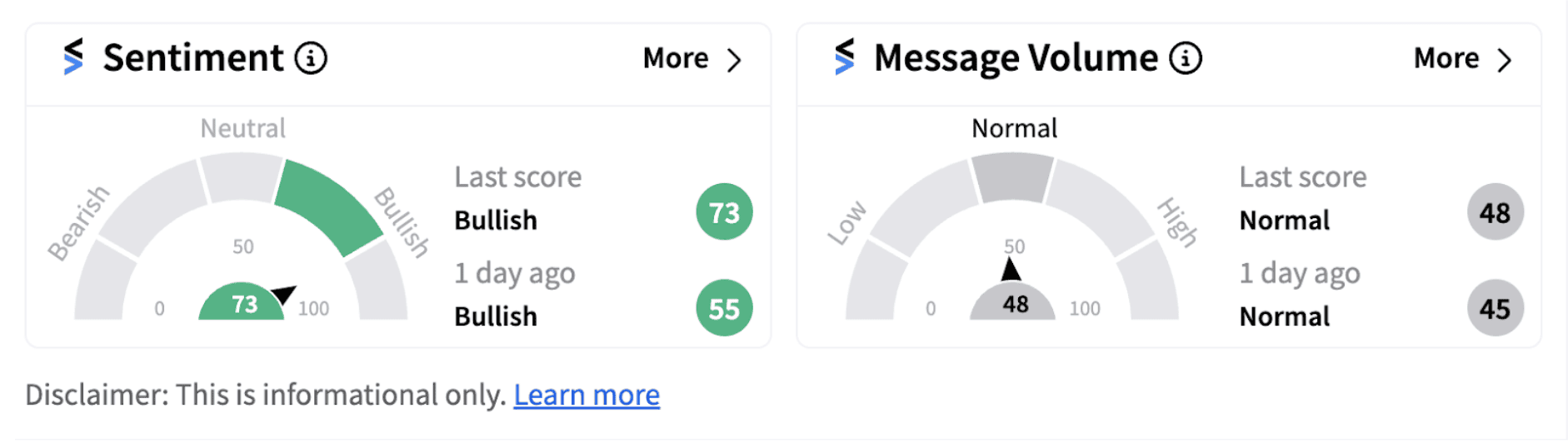

However, Buffett’s firm remains the largest shareholder of the bank, holding over 903 million shares worth nearly $36 billion. The stake sale, however, failed to make any dent in retail investor sentiment that inched-up further into the ‘bullish’ territory (73/100) on Wednesday morning.

Bank of America witnessed a decent second quarter, with revenue coming in at $25.4 billion topping analysts’ estimate of $25.22 billion. Earnings per share came in at $0.83 versus an estimated $0.80.

However, the bank’s net interest income (NII), the difference between interest earned and interest expended, fell 3% to $13.7 billion as higher deposit costs more than offset higher asset yields and modest loan growth.

Provision for credit losses rose to $1.5 billion, up from $1.3 billion in the first quarter and $1.1 billion in the same quarter a year ago.

Notably, the bank also increased its common stock dividend by 8% to $0.26 per share and the board authorized a new $25 billion common stock repurchase program.

The lender’s shares have gained over 17% this year. The stock, after hitting a recent high of $44.30 in mid-July, has corrected about 20%. In early August, it rebounded from its 200-daily moving average near the $35 level and since then it has been rising. Investors will be watching out if it breaks out of the near-term resistance of $44.30.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)