Advertisement|Remove ads.

Why Nvidia Stock’s Potential Breakout Above This Crucial Trendline Resistance May Keep Investors Awake At Night

Nvidia Corp (NVDA) has been one of the top trending stocks this year, having reaped significant gains from the AI boom. The stock has recorded over 156% returns on a year-to-date basis, dwarfing benchmark index returns during the period.

The chipmaker has been in the news lately as CEO Jensen Huang reportedly concluded the sale of six million shares, grossing over $700 million. The sale of shares happened between June 2024 and Sept. 2024, according to an SEC filing.

However, retail investors are taking note of the fact that Nvidia shares are approaching a crucial trendline resistance near the $124 mark. The question is whether the stock will break out or witness another bout of correction.

Some Stocktwits users expect the shares to rally going forward.

Others are waiting for a decline to punch in their buy orders.

Meanwhile, one user with a bearish view is waiting for the stock to hit the $125 mark to buy Put options.

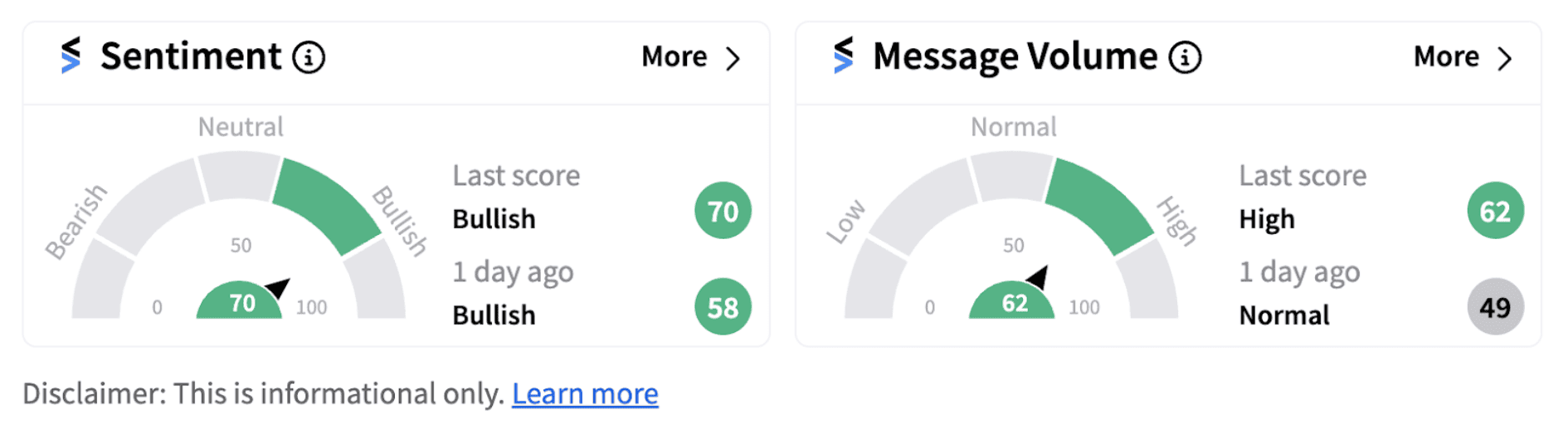

However, the majority of Stocktwits users are positive on the stock, as is reflected in the sentiment meter that continues to trend in the ‘bullish’ territory.

If Nvidia shares manage to jump above the trendline resistance, investors will be keeping a watchful eye on the stock to understand how convincing the breakout is. This is because the stock has already delivered massive returns this year and investors appear to be a bit jittery about the market’s dizzying levels coupled with the chatter about the possibilities of a recession.

Notably, Nvidia recently gave up its top performer position in the S&P 500 to Vistra Corp (VST). But Melius Research’s top tech analyst Ben Reitzes believes there is reason to stay bullish on the chipmaker.

“In short, Nvidia is cheap on its growth, it’s getting its volumes better in Blackwell, which is going to help margins, and better visibility on earnings power and long-term growth should be the next catalyst for the stock,” Reitzes said, according to a Barron’s report.

Also See: Bank Of America CFO Says Fed Winning Battle Against Inflation: But Bond Market Has A Different Take

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)