It was a slow day out there, but several commodities caught traders’ eyes. Let’s see which ones. 👀

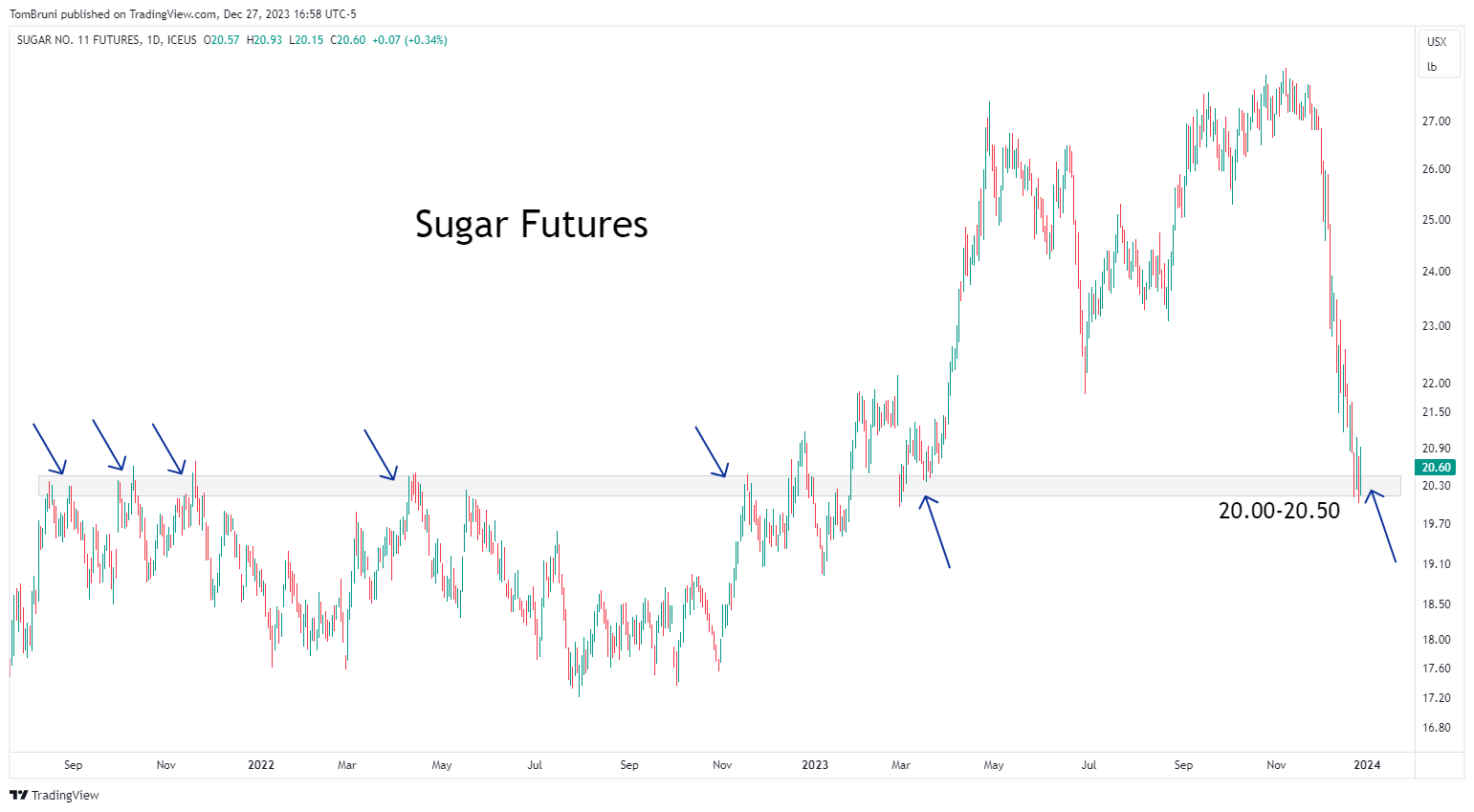

First up is sugar futures, which have experienced a nearly 30% decline since the beginning of November. While its major decline is one reason to be on people’s radars, technical traders say prices have reached the 20-20.50 area that served as an inflection point over the last two years.

They’re looking for prices to dig in here and potentially retrace some of this steep decline over the coming days and weeks. 💵

Meanwhile, on the other end of the spectrum, we’ve got gold futures trying again to break out above resistance near 2,090. The precious metal gave it a go earlier this month, but was unable to close above that level it failed at several times over the last few years.

With volumes being lighter during this holiday trading period in the markets, some traders say this is a great opportunity for buyers to step in aggressively and complete this breakout. 🐂

We’ll have to wait and see how these play out. But in the commodities space, these two charts are some of the most widely talked about in our community. 💬