It’s Friday, and we’re all looking forward to the weekend, so we’ll keep this article short. With almost every speculative asset on the planet participating in the recent rally, let’s quickly check in on two commodities making moves. 👀

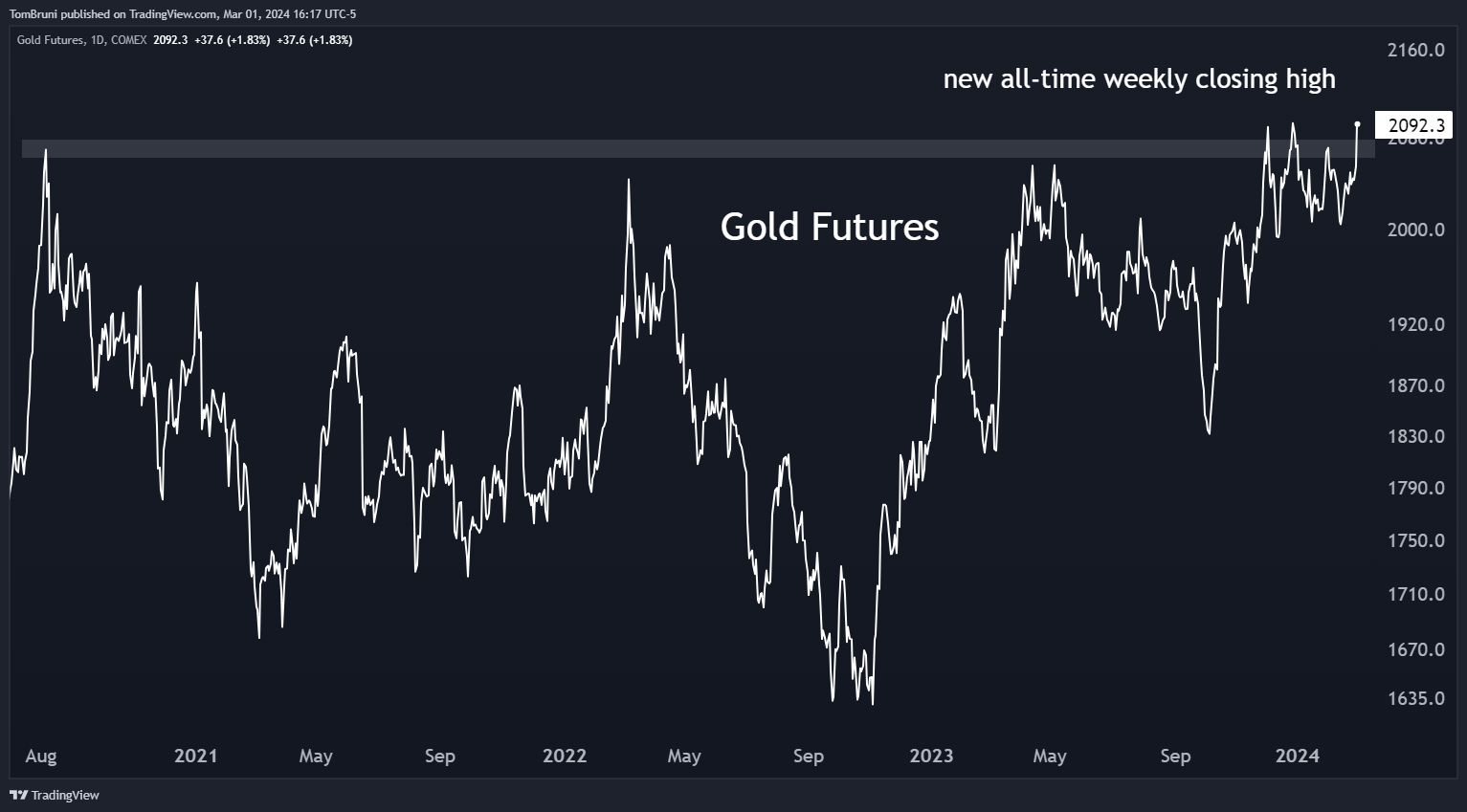

We know digital gold (aka Bitcoin) has been absolutely crushing it, but physical gold has failed to participate. That is at least until today… 🤔

The nearly three-year chart shows a new all-time weekly closing high in prices, as buyers look to clear resistance in the mid to high $2,000s. Sellers have stepped in at these levels for the last three years despite inflation and economic uncertainty rising.

We know technically oriented traders and investors are watching to see if gold can decisively clear this level in the coming days and weeks. 🪙

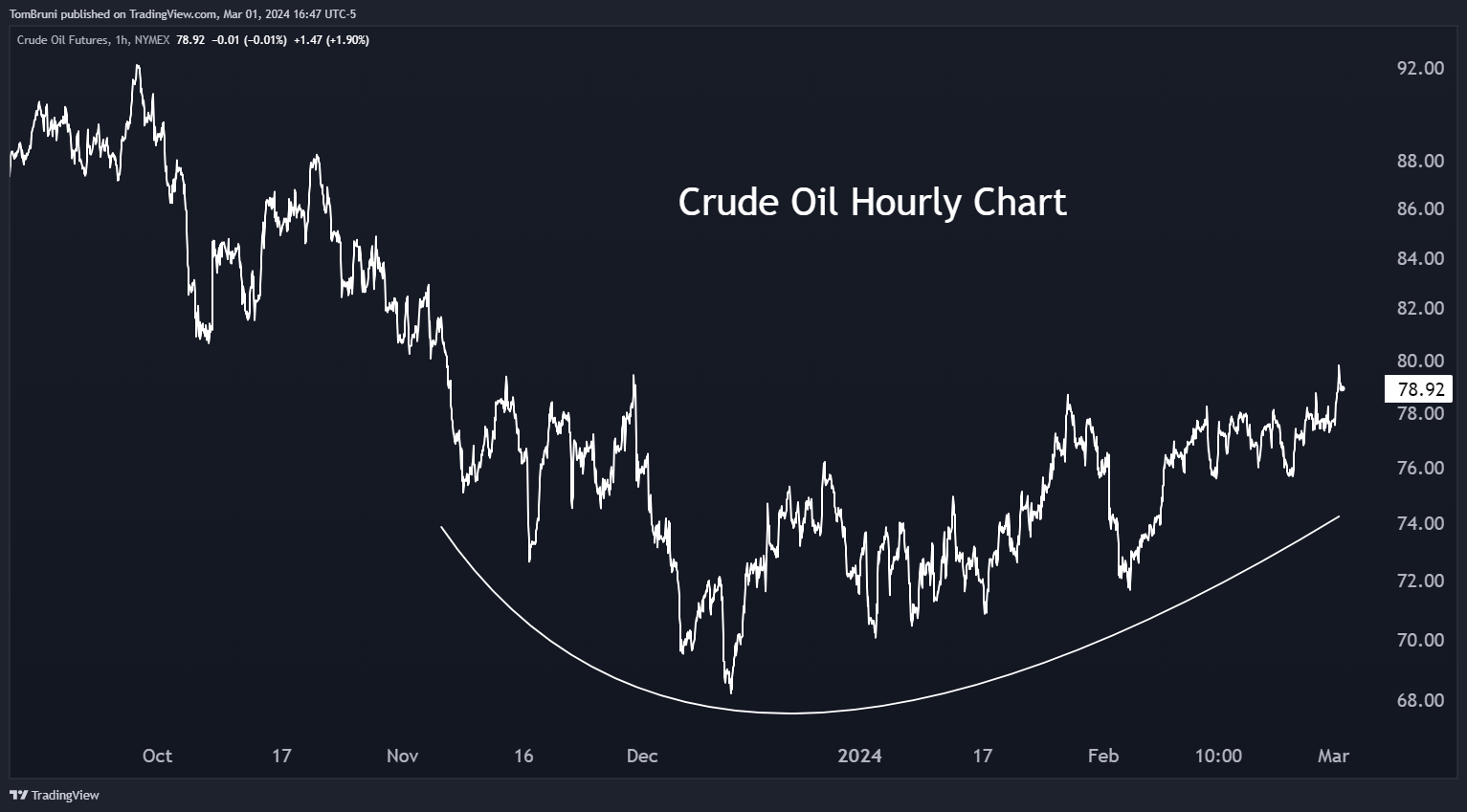

Next up, we want to point out that crude oil is creeping higher. The hourly chart shows prices bottoming in December and slowly grinding to the upside. While the rest of the market is focused elsewhere and economists declare inflation dead, it’s an interesting development worth watching. Especially as other commodities like cotton, cocoa, and more have rallied sharply. 🛢️

Overall, commodities have not been in focus for quite some time. But we all know how riled-up market participants can get over gold and oil, so we’ll likely see them make headlines in the weeks and months ahead. 📰