We can’t not look at how insanely high some commodities have moved.

Frozen Orange Juice Futures

New all-time highs and up nearly +250% since February 2020.

The only thing more freshly squeezed is my wallet. 🍊

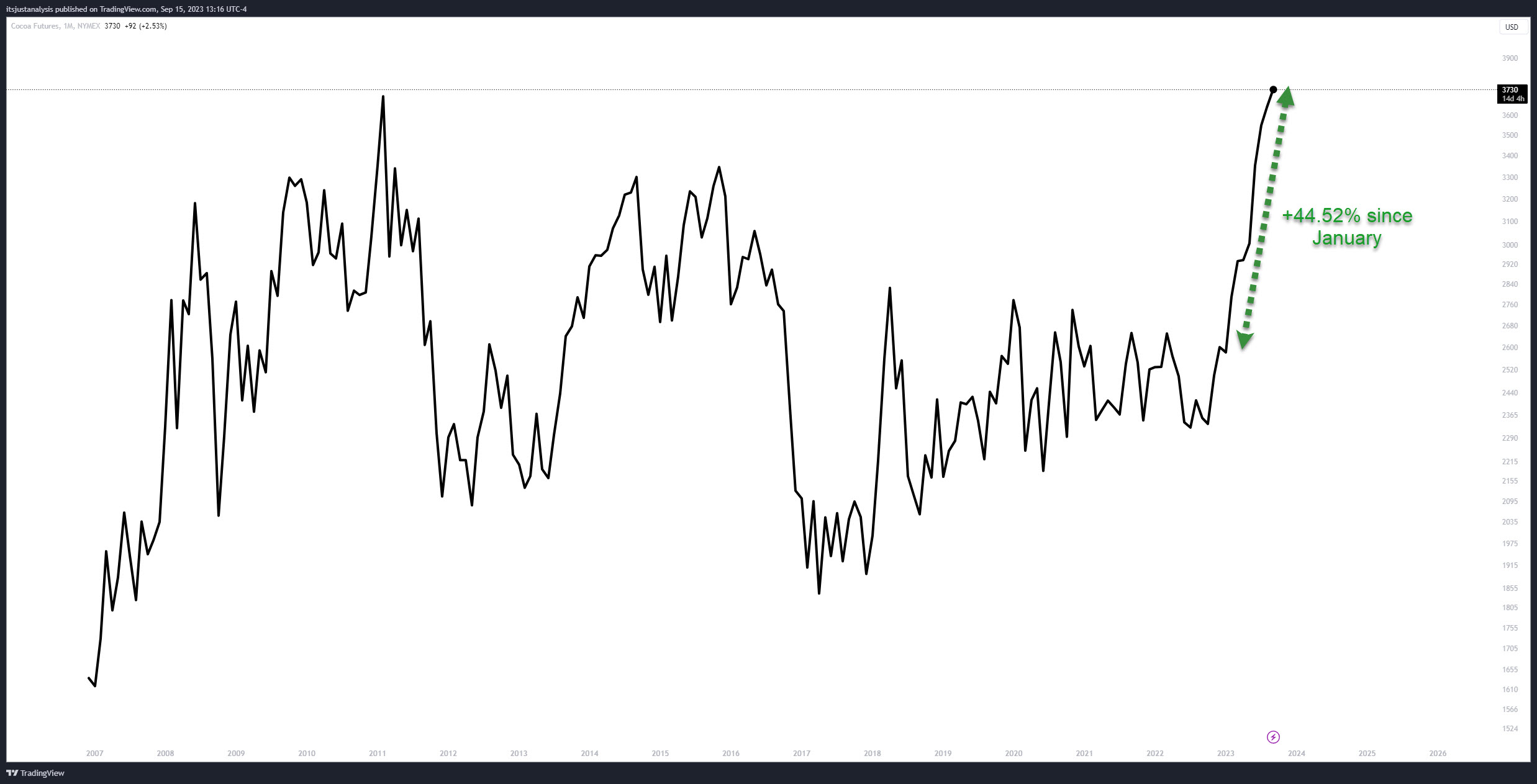

Cocoa Futures

Not only are cocoa futures up over 44% since the beginning of the year, it’s trading at new all-time highs.

Valentine’s Day 2024 just got a lot more expensive.🍫

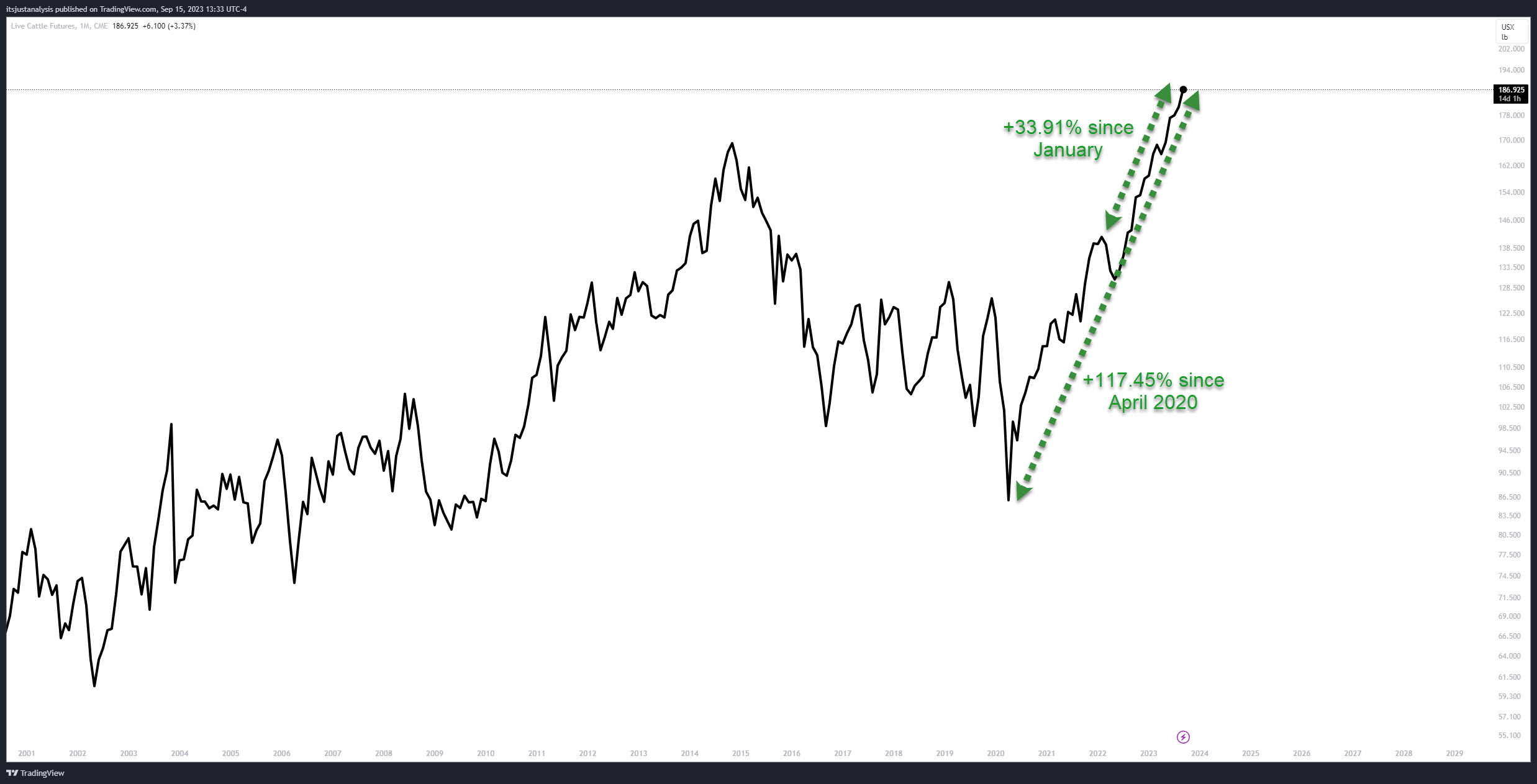

Live Cattle Futures

If new all-time highs and a +33.91% gain since January weren’t crazy enough, then about an insane +117.45% gain since the April 2020 lows?

Ribeyes keep getting smaller and more expensive at the same time. 🐮

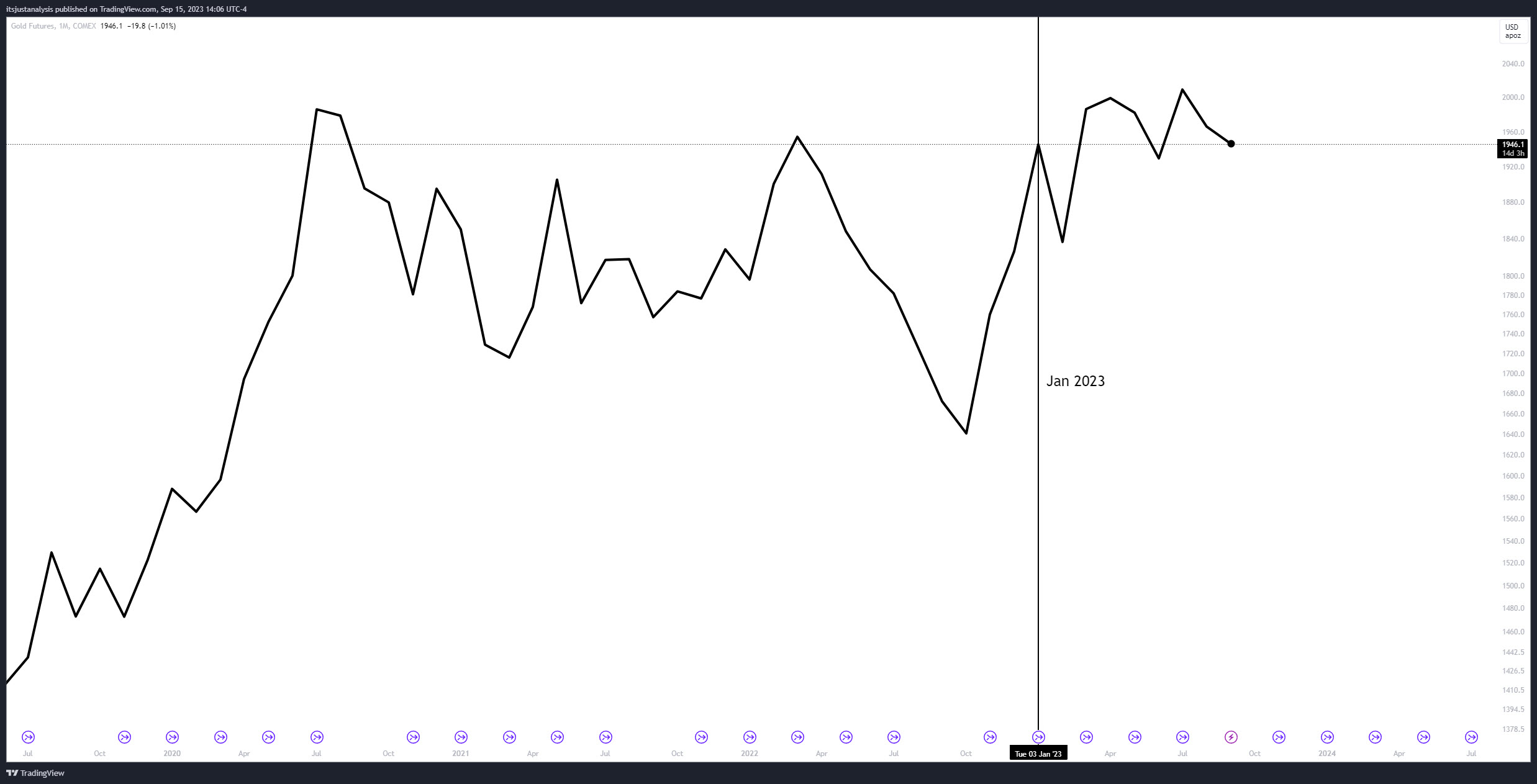

Gold Futures

Even though gold isn’t showing off the same YTD gains as the three above commodities, July 2023’s close was the highest monthly close ever.

And even though gold has moved a little lower, it’s still parked pretty damn close to those highs. 🥇