The struggles at Beyond Meat continue.

Today, the company drastically cut its revenue outlook for the second time due to slowing demand for faux meat as consumers look for chapter options in the current inflationary environment.

Like other growth companies struggling to deliver results, they’re now focusing on cost-cutting to achieve profitability. It’s cutting roughly 200 jobs this year, resulting in about $39 million in cost savings over the next twelve months. 💰

Accompanying the job cuts is a shakeup among its executives. Its finance chief Philip Hardin is leaving at the end of the month. And its operations head Doug Ramsey left the company shortly after it suspended him for allegedly biting a man’s nose.

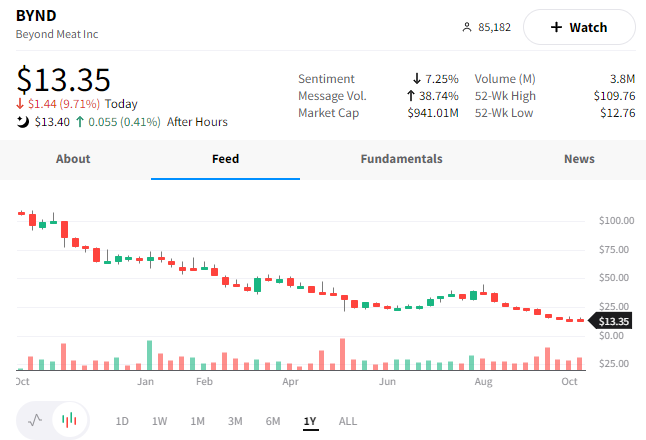

Overall, most investors still don’t believe the turnaround story. $BYND shares fell another 10% today to fresh all-time lows in what appears to be a “death by 1,000 cuts” situation. 😬