It’s another day that ends in Y, which means that Elon Musk is back in the news. 📰

First, people were talking about Musk this weekend because he became the first person ever to lose $200 billion. 😵

Additionally, Twitter remains heavily talked about as Musk drives changes at the company. Lawsuits against the company continue to roll in, this time with a San Francisco landlord suing the company for not paying rent.

SpaceX raised roughly $2 billion in 2022, but it’s adding to that as we head into 2023. Reports are the reusable rocket maker and satellite internet company is raising $750 million at a $137 billion valuation. 🚀

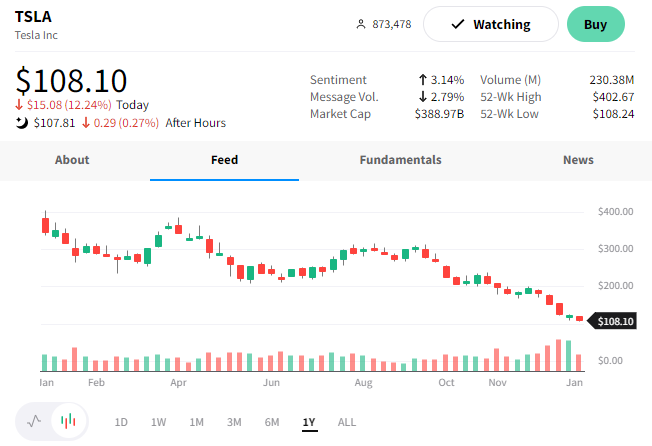

Lastly, $TSLA shares made fresh lows to start the year, falling over 12% today. The stock reacted to the company’s 2022 year-end vehicle production and delivery numbers, which were not as good as expected. 👎