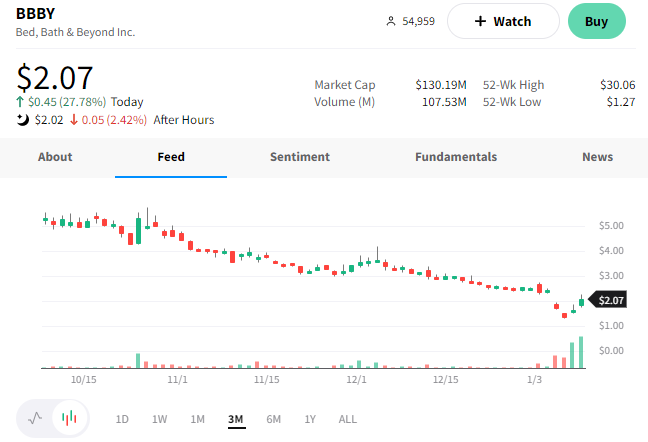

The Bed Bath & Beyond saga continues this week as prices rally 28% despite its earnings miss.

The company’s adjusted loss per share was $3.65 vs. the $2.23 expected. And revenues of $1.26 billion missed the $1.34 billion. 👎

So why the rally? It’s hard to know precisely, but the stock has essentially moved straight down from its August highs. It’s down around 95% from peak to trough since then. Last week’s “going concern” warning exacerbated the selling and overall negative sentiment. But even bad stocks can only go down so far so fast before experiencing a counter-trend rally.

Most investors and traders expect the volatility to continue. While many agree the company is likely heading for bankruptcy, they’re now trying to assess what it looks like after its reorganization. And what value is left for common shareholders to claim? 🤔

That discovery process means that the share price will continue to bounce around wildly as more news comes out and the market has more clarity about the company’s future. In the meantime, traders/investors will continue to react to the ongoing news releases and debate the company’s future.

For now, sentiment on the $BBBY streams remains highly negative, and message volume remains extremely high (relative to their 20-day history). 😮

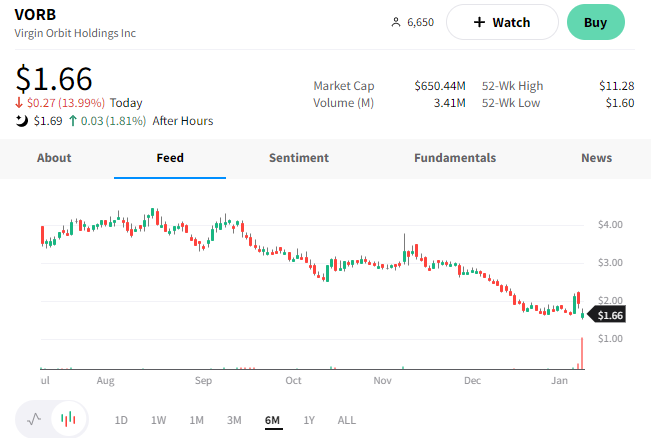

Similarly, Virgin Orbit’s $VORB stream is experiencing similarly bearish sentiment and high message volume. 🚀

Last night was the company’s sixth mission and its second failed launch. With it being Britain’s attempt to become the first European nation to launch satellites into space, there was obviously a lot riding on this launch.

The failure was extremely public for Virgin Orbit, which uses a modified 747 jet to send satellites into space. As such, it’s not surprising to see its shares continue their decline, reaching a new all-time low of $1.50 (~$500 million market cap). 🔻