It’s no secret that meme stock Bed Bath & Beyond’s underlying business is in trouble. But Thursday, the company added to investor fears, citing worse-than-expected sales, as it issued a “going concern” warning.

Essentially, the company believes it will not have the cash to cover its expenses at some point in the near future. Its stalled turnaround story and mounting losses have caused it to burn through its cash reserves with no end in sight. 📉

As a result, executives are exploring financial options like restructuring, seeking additional capital, or selling assets. Their ultimate goal is to rebuild the business so that its brands can “remain destinations of choice for customers well into the future.”

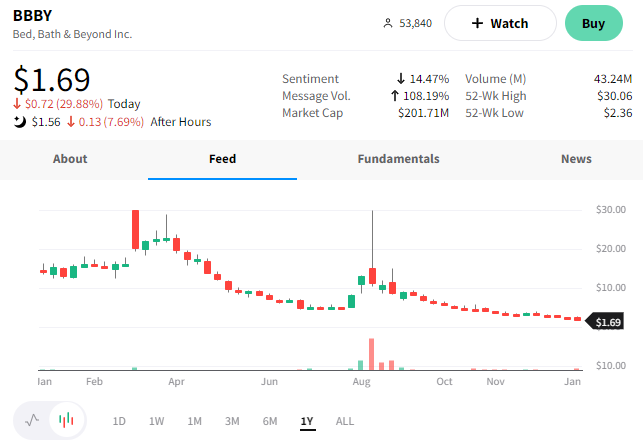

With that said, many sources expect a bankruptcy filing is likely in the coming weeks. The news sent $BBBY shares plummeting another 30% to their lowest level since 1993. 😱