After several months of failing to secure funding, Virgin Orbit has confirmed that its last-ditch effort to team up with investor Matthew Brown has failed. ❌

The satellite launching company had furloughed its roughly 750 employees on March 15th as it looked to secure funding. Last week, it slowly brought back some of its 750 employees as funding prospects improved. However, executives announced today that they’re ceasing operations “for the foreseeable future” and will lay off 90% of their workforce. 🛑

Virgin Orbit was spun out of Sir Richard Branson’s Virgin Galatic in 2017, with him maintaining 75% ownership. The company’s system of using a modified 747 jet to send satellites into space was met with much optimism. However, the challenging funding environment caused the company to raise less money than expected via its SPAC merger in 2021. And operational issues, including a mid-flight failure of its last launch, have investors doubting the company’s long-term viability.

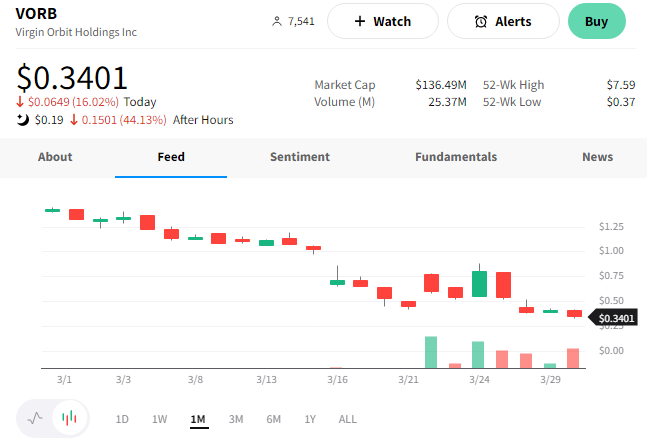

With its largest shareholder unwilling to provide more funding and its stock plummeting to fresh all-time lows, it’s running out of options. So it recently hired bankruptcy firms to pull together contingency plans if it cannot find a buyer or investor. 📝

Overall though, it appears the shareholders and outside debt holders will be hurt the most. Richard Branson has first priority over the company’s assets. And the Board of Directors recently approved a “golden parachute” severance plan for the company’s top executives in the event they’re terminated.

As with many revolutionary ideas, they don’t always pan out. The idea will likely live into the future, but probably not in its current form. So we’ll have to wait and see whether the company’s prospects change in the coming days. 🤷

In the meantime, $VORB shares hit fresh all-time lows on the news. 💥